The Narendra Modi government is likely to propose imposing long term capital gains (LTCG) tax on equity investments in the forthcoming budget , according to a report in The Hindu Businessline.

So far, the market participants have taken a strong view against the tax citing certain reservations about it.

In the past, the Modi government had indicated it will bring in a new tax for stock market investment as it felt at that time that taxes on gains made on equity holdings were not much when compared to taxes on gains from other instruments.

The HBL report says the finance ministry is working on the contours of such a tax. Either it could abrogate two separate taxes – on short term gains and on long term gains – or increase the period for short term gains tax to three years from the current one year, the report said.This would bring more stock market investments under the tax bracket.

Since 2005, there has been no tax on gains made on sale of equity held for more than a year. However, there is a 15 percent tax on gains from equity investment of less than a year, the report further says.

With an aim to promote investments – from retail and institutional investors – the government had exempted certain gains from tax.

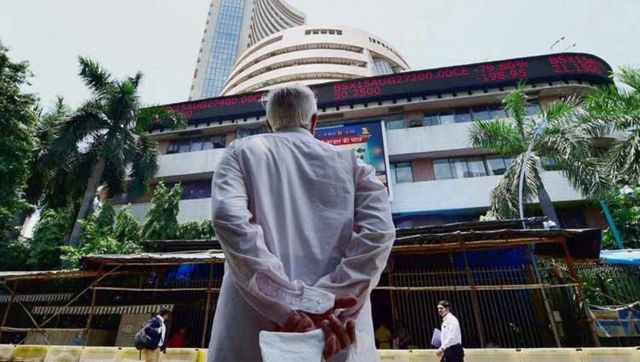

The proposal, if it is indeed taken up, comes at a time when the Indian stock markets are on bull run. The Sensex and Nifty have been hitting record highs due to liquidity inflow from not just foreign investors but even the domestic institutional and retail investors.

The Sensex has risen 28 percent over the last one year, with the BSE market capitalisation swelling by Rs 45.56 lakh crore to Rs 151.80 lakh crore.

The government is also facing uncertainty over the tax revenues on account of the newly introduced goods and services tax. The government has been adjusting the new system by cutting rates and rescheduling the returns filing deadline in order to lessen the pain of the new tax regime on the consumers and businesses.

As per the latest figures, the GST collection in November stood at 80,808 crore, a decline for the second consecutive months. GST collection in July was over Rs 95,000 crore, in August over Rs 91,000 crore, in September over Rs 92,150 crore and in October over Rs 83,000 crore.

There are fears that the uncertainty in the tax revenue is likely to upset the fiscal math of the government in the coming Budget .

For full coverage of Union Budget 2018, click here.

)

)

)

)

)