SUMMARY

Airtel has given Jio a tough fight although the older telco has lost its market leader’s position to the RIL subsidiary

Jio is investing heavily to grow its bouquet of digital services, but Airtel is taking measured steps to stay ahead in the digital revenue race

Brand Airtel is positioned well but can digital offerings win Airtel the lost telecom crown?

Jio Platforms, a 67% subsidiary of India’s business behemoth Reliance Industries (RIL), has been in the news throughout 2020. And the reasons are many. For starters, it is a young company, only incorporated in 2019, but still houses most of the INR 13 Lakh Cr group’s digital businesses unless they are already clubbed under Reliance Retail Ventures (RRVL). Second, and more importantly, Jio has raised more than $20 Bn (INR 1.5 Lakh Cr) from top global investors and the who’s who of Big Tech even when businesses came to a shuddering halt in a Covid-hit world.

These eye-popping investments did not happen without a reason. According to industry experts, Jio Platforms aims to go much beyond its core telecom business and evolve into a broader base for a bouquet of apps and digital services, from education and agritech to healthcare to e-governance and everyday essentials like groceries and more. But for Jio or its telecom peers in India, it is not an overarching dream, but a must-follow route to making big money as the sector ARPU (average revenue per user) is far from sustainable, thanks to the below-cost pricing of voice and data plans. Unless companies are ready to tap into the fast-growing Indian market driven by the next billion of internet users, their growth cannot be aligned with a Digital Bharat.

The recent developments, especially the huge business potential of digital services that Jio is trying to leverage, have not escaped the notice of its arch-rival Bharti Airtel. Once the undisputed leader in India’s telecom market, it is again prepping for a bruising war with Jio Platforms and says that the company is working on strategies to generate ‘meaningful revenue’ from its digital offerings, including entertainment and financial services, within the next three-four quarters. The telco has not detailed how this ‘meaningful’ revenue would boost its business or whether it would help in recapturing the market.

Even though Airtel is not far behind Jio in terms of subscriber usage metrics according to its recent performance in the mobile space, how is the company placed to build its digital revenue stream when Jio is already out there and developing a connected digital ecosystem? Jio Platforms has reported more than INR 1,000 Cr in revenue in the second quarter (July-September 2020) that accounted for 5% of its non-mobile earnings. Of course, Airtel has been working on it through products, partnerships and commerce (large-scale retail) solutions for five years or more. And around 21% of Airtel’s India revenue comes from non-mobile businesses thanks to their large enterprise solution offerings.

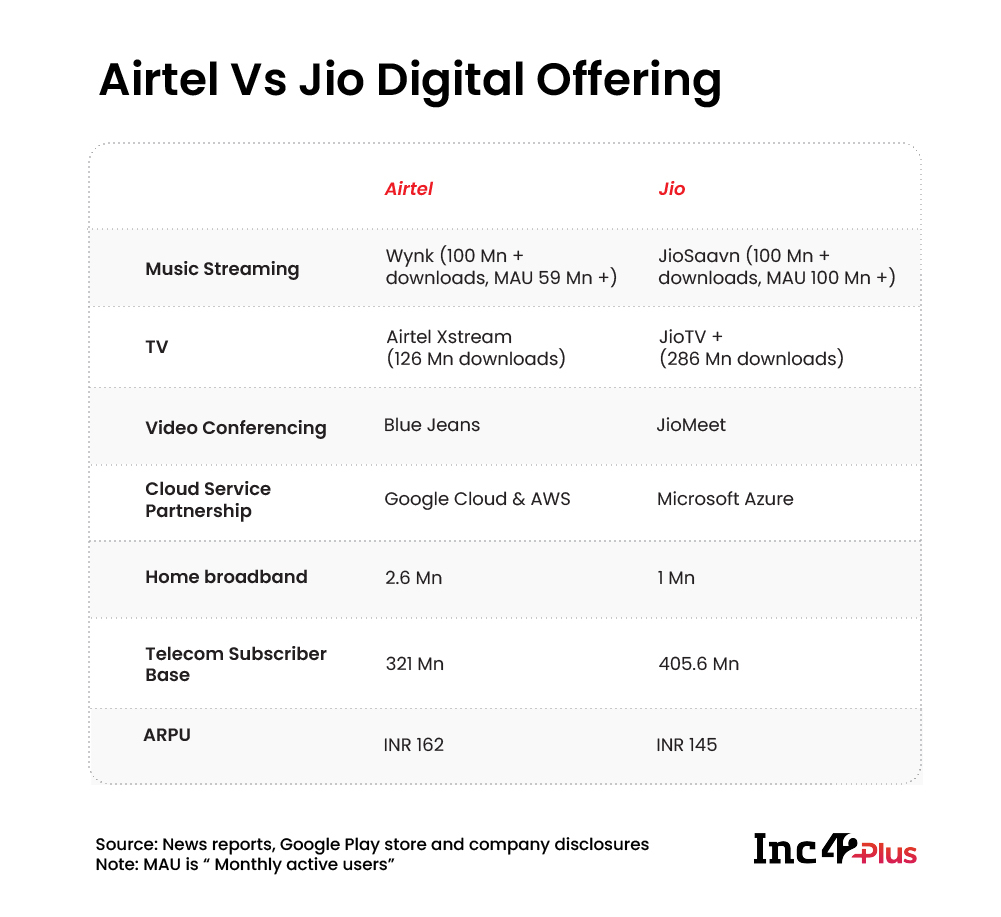

How Airtel Stacks Up Against Jio In Digital Solutions

Bharti Airtel currently has industry-leading usage metrics, with data consumption standing at 16 GB a month per user and voice usage at 1,005 min a month per customer. In contrast, Jio’s metrics stand at 12 GB and 776 min per month for data and voice usage, respectively. These are certainly a few red marks on Jio’s overall report card as Airtel continues to see high-value usage in spite of a lower subscriber base. As of now, the older telco has 326.6 Mn subscribers compared to Jio’s 400 Mn-odd subscribers. But are these Jio users pushing its ARPU northwards? What’s more, will there be an uptick in the use of digital services, thus driving in more revenue and exponential growth?

Industry analysts have long questioned why telcos, with a massive number of subscribers, could not monetise their user base until Jio came into the picture. Telcos, of course, have introduced several apps and add-on digital services to provide access to over-the-top (OTT) content, music and digital TV. But these were mostly developed for the purpose of more extensive user-profiling so that monetisation can happen at a clip in the 4G era. Monetising 2G/3G data users was difficult as limited services could be supported on these networks. Now, these are being phased out and a paradigm shift is happening in terms of revenue as India’s mobile app economy is maturing fast.

Jio Platforms has clearly built a huge presence here. Since its incorporation as an umbrella entity for RIL’s various digital service verticals, Jio has launched more than 30 apps for both consumers and partner ecosystems. These include RIL-owned digital businesses such as My Jio (a mobile subscriber management app), JioTV (digital TV), JioSaavn (music streaming), JioMeet (video conferencing), JioMart (online shopping) and may more across entertainment, media, edtech and healthtech space. The outreach has grown significantly as these apps are available across low-cost Jio feature phones running on 4G. However, Airtel customers accessing similar apps can be easily identified as a high-spending user base.

Some of Airtel’s digital offerings existed even before Jio’s entry. But the big push to boost their service and traction only came in the past three-four years. Airtel Wynk (music streaming) and Airtel Digital TV (DTH or direct-to-home service) are cases in point. Together with the Airtel Thanks app, the Blue Jeans (video conferencing) partnership and edtech offerings through startups and the DTH service, Airtel has made sure to be available in some segments where Jio is present. But the big difference is: The Airtel management has always maintained that ecommerce/retail offerings like a JioMart are out of scope for a telco.

But unlike JioMart, Airtel is taking a different route into commerce – that of distribution.

“We have a huge network of touchpoints across Airtel stores, distributor network, apps and telecom subscribers, and we want to offer this network as a platform to partners,” said Adarsh Nair, Chief product officer of Airtel.

Airtel claims more than 165 Mn users are active across its digital services. For instance, 1.1 Mn retailers are transacting on the Mitra app, and around 155 Mn monthly active users are using Wynk, Xstream and Thanks apps. This is the user base the telco aims to monetise through product partnerships as it did last year with HDFC Bank to launch a prepaid bundled plan with in-built life insurance cover.

The telco is seeking to build its payments bank platform as a connecting touchpoint across its app universe. While payments bank as a concept has been deemed a failure by the banking industry, Airtel’s payments bank is among the top three in this space due to an early mover advantage. Jio Payments Bank, in spite of its partnership with the country’s biggest lender, the State Bank of India, has been mostly invisible in this market.

Then there is the enterprise B2B market for tech solutions that both Airtel and Jio are after. With almost 21% of Airtel’s revenue share coming from the enterprise business alone, the telco has been a clear winner so far, especially since Jio’s strategy in B2B enterprise solutions is not crystal clear yet. Within the past few months, Airtel has further strengthened its enterprise offering beyond communications and cloud services to provide security and customer service solutions through various partnerships. This also includes Airtel IQ, an enterprise communication focused omni-channel solution for businesses to integrate services (like messages and IVR) within applications itself.

As a cloud service provider, even without its recent Google Cloud and AWS partnerships, Airtel has long-standing customer engagements, and hence, commands premier pricing from enterprises. But when the focus on the next set of customers changes to the price-conscious and pandemic-scarred small and medium businesses (SMBs), the story is different, especially with Reliance Jio seeking out a Microsoft Azure partnership to go after this user base.

Although Jio has been quite vocal about its new commerce solutions targeted towards kirana shops, Airtel is quietly exploring its options in supply chain and store digitisation technologies. However, as Nair pointed out, the telco would only start talking about these solutions when they show substantial value.

Analysts are concerned, though. Given Jio’s penchant for disruptive pricing, SMBs and kiranas could be a tricky area for Airtel that mainly deals with enterprises. The online grocery opportunity in the country was pegged at $500 Bn by a 2019 report of management consulting company Redseer. There was a half-a-trillion-dollar opportunity of taking 13 Mn mom-and-pop stores to the digital phase, but only 0.2% had come online at the time.

“SMBs are in a volume business, and a premium enterprise presence need not have the same perception in this market. Jio already has a presence in the retail sector. So, when both Airtel and Jio seek to offer cloud and networking solutions to this market, they will be judged on the same economies of scale,” said Ankit Jain, Assistant vice-president of ICRA, a credit rating agency.

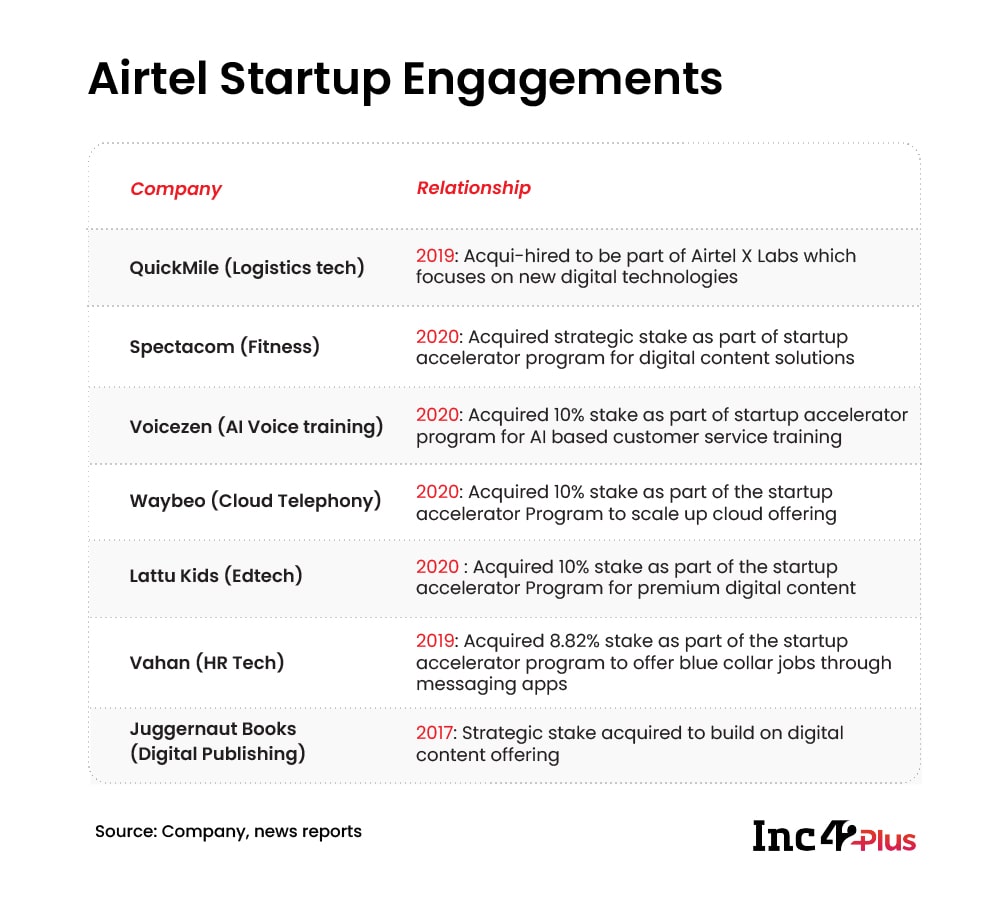

Finally, The Startup Play

Startups are central to Reliance Jio’s digital vision, with Jio Platforms partnering with more than 20 startups since its launch. Out of these, 11 startup acquisitions were announced in 2018 and 2019. These include C-Square, EasyGov, Embibe, Fynd, Grab, Haptik, Netradyne, Reverie, Saavn, SankhyaSutra, Nowfloats and Tesseract. RIL has also made significant investments in global tech startups such as DEN, Radisys Corp, Videonetics, Kai OS Technologies and SkyTran, among others. Jio’s focus on 5G, agritech, healthtech and edtech startups is also covered through Jio’s startup accelerator programme. The company has acquired majority stakes in startups which fit into its digital vision and spent little time in grabbing entire ownership.

Bharti Airtel, on the other hand, has taken an extraordinarily measured approach towards startups, almost baby steps compared to Jio. The Airtel Startup Accelerator has acquired strategic stakes (in the range of 10%) in a few companies such as cloud telephony-enabler Waybeo, HR tech-enabler Vahan, fitness content startup Spectacom, edtech firm Lattu Kids and Voicezen, a conversational artificial intelligence (AI) company. In fact, the only consumer-facing edtech initiative that Airtel has launched is through its DTH offering in partnership with Aakash educational services.

Startup analysts have expressed concerns that unlike Jio, whose startup investments make sense as a part of its overall play across its digital ecosystem, Airtel’s startup investments are yet to show a meaningful contribution to its vision.

“For us, an acquisition is a step that comes when we realise that a certain business is critical to our business. In any other situation, we are happy to partner with companies in this space,” said Nair.

Then there is the entire 5G game that Jio has been itching to start even as Airtel continues to stall. With zero 2G-3G solutions and 5G startups in its kitty, Jio is more than ready for 5G spectrum and the possibilities it brings across edtech, agritech and communications. But for Airtel, which is still coping with massive debts, such investments are out of the picture for now.

Airtel Vs Jio In Digital Value Bet

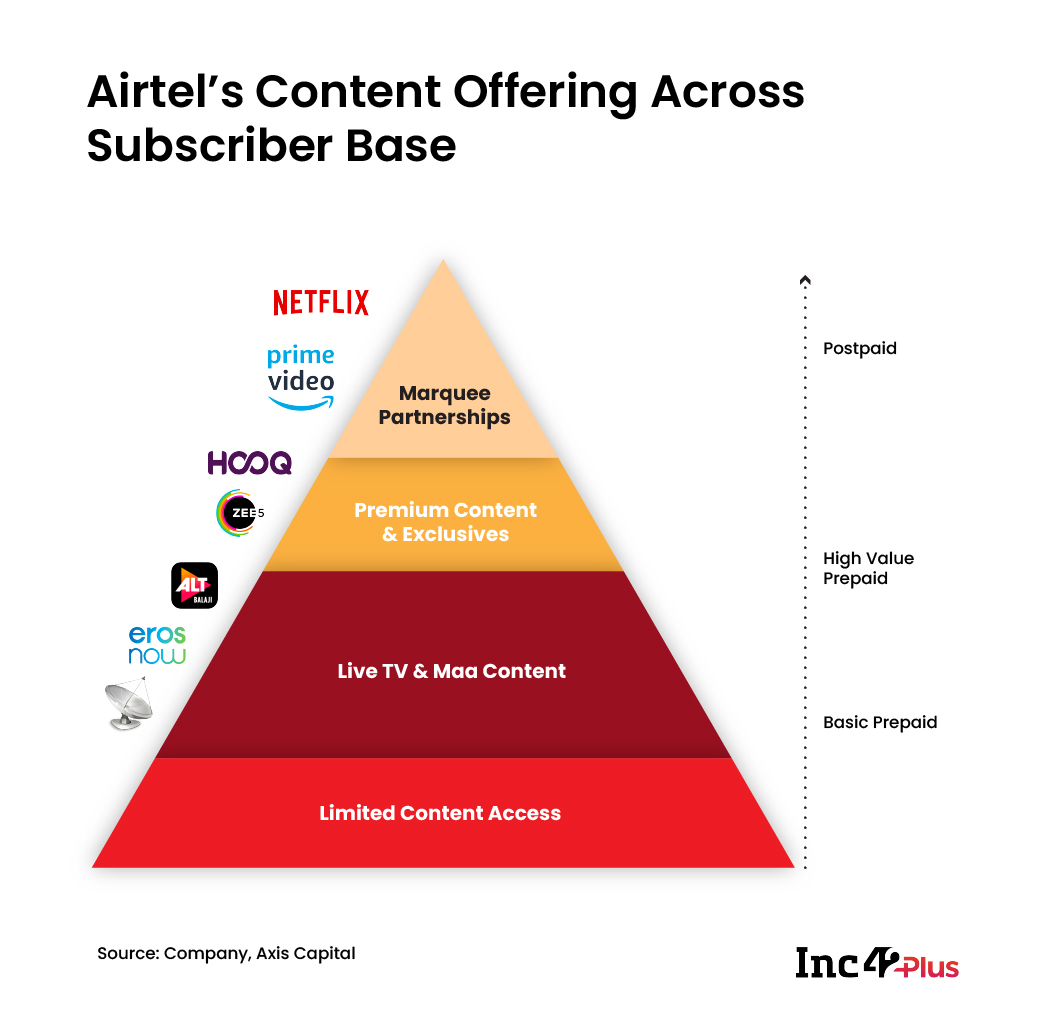

For monetisation strategies to work for any telco, its big-spending postpaid customers are a top priority, and Airtel has balanced this section of its user base effectively, say analysts. During the Q2 FY21 earnings call, the company’s top management told investors that “general entertainment” offerings like streaming services, bundled with (low-ARPU) prepaid plans, did not convert to meaningful traction. However, higher-cost bundled plans above INR 499 were certainly witnessing better traction from premium users.

Among high spending users, postpaid plans contributing to 15-20% of Bharti’s revenue and data suggest that this customer base is extremely sticky. “Jio has an INR 199 postpaid plan at a 60% discount to Bharti’s entry-level postpaid plan for over two years. However, when we observe Bharti’s postpaid plan, we see no evidence of churn. In fact, Bharti’s postpaid customer base has marginally increased over the past two years (by 0.5 Mn). Vodafone Idea’s postpaid base was down 10% during this period,” noted a September research report by Goldman Sachs.

To add to its monetisation efforts, Airtel has been working on an advertising tech solution. It is now tested across part of its user base and a select few advertisers are also trying it out. This is certainly not an area that Jio is known to be exploring yet. Airtel has not detailed this all-new adtech solution, but experts see better customer segmentation opportunities across the wide customer base that Airtel has.

According to telecom analysts, with a premium and mostly sticky customer base, Airtel can offer better value to digital partners in a way that Jio has not unlocked so far. While these measures do have a meaningful impact in the long run, it will definitely take some time to convert into a revenue stream, given the overall level of digitisation across telcos.

“Given the current status of the telecom operators, it will take three-four years for their (data-monetisation based) digital measures to convert to even 10% of their revenue stream,” said Rajiv Sharma, head of institutional equity research, SBICAP Securities.

That said, both in the enterprise and overall digital solution space, Brand Airtel commands a certain level of trust, say analysts across the board. If Airtel can maintain this brand perception long enough to convert it into digital revenue streams meaningfully, it can hope for an advantage in this space.

According to experts, if Airtel can successfully unlock its data monetisation opportunities and manage to grow its smartphone user base beyond the current 60%, it can build a robust digital revenue stream with its premium subscriber base. But this will hold only if the third telco, Vodafone Idea, manages to stick around long enough, given its serious financial problems. If VIL collapses soon and India becomes a two-player market, Airtel’s play, based on its premium users, may pan out differently in sync with the new market dynamics. And the digital revenue race could again be wide open for Airtel and Jio.