Indian Telecom sector is bleeding!

Telecom sector crisis shows India is hanging up on the future...

An Overview

Telecom sector in India is over 165 years old. Introduction of Telecommunications in India dates back to 1851 when the first landlines were made operational by the government at a place near Kolkata. Telephone services were formally introduced in India in 1881 and were subsequently merged with the postal system in 1883. Post-Independence, Posts, Telephone and Telegraph body was formed by the nationalization of all telecommunication companies and its governance was under the Ministry of Communication.

Indian telecom sector was government-owned until 1984, post which the private sector was allowed to manufacture telecommunication equipment only. The industry evolved only after the Department of Post and Telegraph was separated in 1985 and a new Department of Posts and the Department of Telecommunications (DoT) was formed.

India is currently the world’s second-largest telecommunications market with a subscriber base of 1.20 billion and has registered strong growth in the past decade and half. The Indian mobile economy is growing rapidly and will contribute substantially to India’s Gross Domestic Product (GDP), according to report prepared by GSM Association (GSMA) in collaboration with the Boston Consulting Group (BCG).

The Problem

Recent days have predictably fetched bad news from India’s telecom sector which, barring a major player, is equally predictably staring into a big black hole that threatens to suck them into, to use their words, “imminent collapse”. From being the world's cheapest and fastest growing market, India's telecom sector is sputtering as it faces life-threatening liability running into billions of dollars, a crisis that may alter the character of an industry that has already seen a painful price war destroying profits and push several operators out of the market.

The problem with telecom sector originated the moment it began to be viewed as a cash-cow for the government in terms of raising its non-tax revenues. The vibrant sector appeared as a solution to raise revenue without having to privatize or disinvest existing public sector enterprises.

The AGR Context

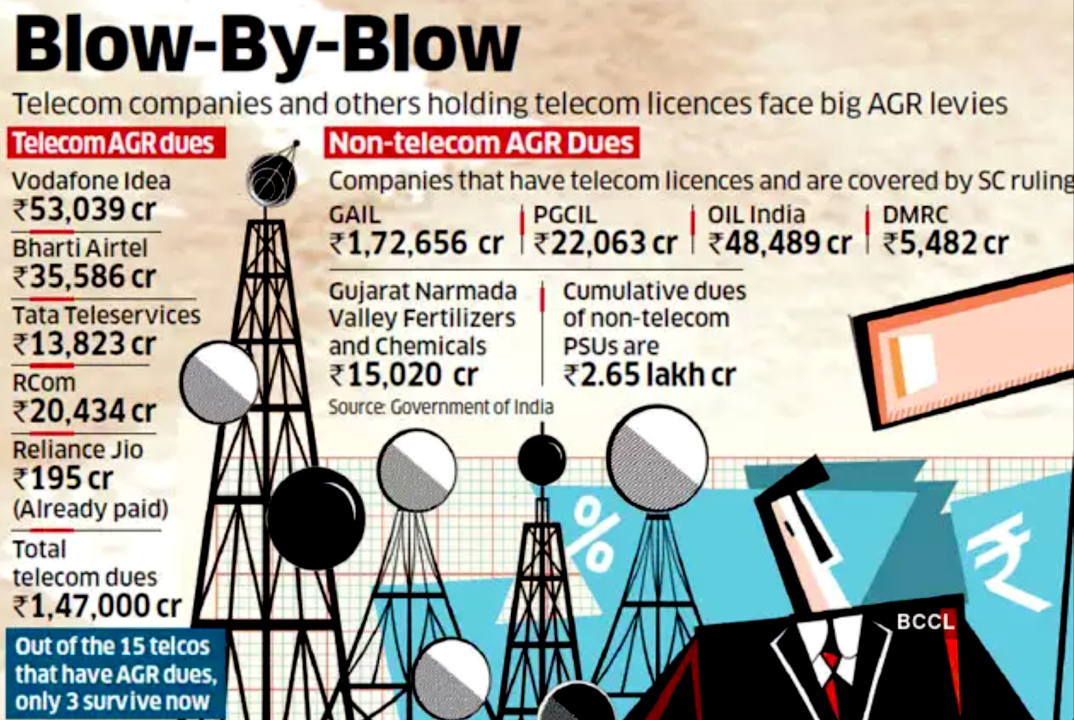

Nearly five months after winning its legal battle in the Supreme Court against telecom majors including Vodafone and Bharti Airtel for payment of Adjusted Gross Revenue (AGR) dues worth several lakhs of crores of rupees, the Centre did a virtual U-turn on Monday by urging the court to give the companies a 20-year window to pay the money back. The dues stood at ₹1.69 trillion as of October, 2019.

What is AGR and the issue?

- The AGR is divided into spectrum usage charges and licensing fees, pegged between 3-5 percent and 8 percent respectively.

- As per DoT, the charges are calculated based on all revenues earned by a telco – including non-telecom related sources such as deposit interests and asset sales.

- Telcos, on their part, insist that AGR should comprise only the revenues generated from telecom services.

- The Telecom Regulatory Authority of India (TRAI) has in its recommendation paper agreed on many of the sector’s demands such as the exclusion of income from dividend and capital gains on account of profit on the sale of assets and securities.

Concerns:

- Already stressed sector: This order has added to the stress of the telecom industry reeling under a debt of over ₹4 lakh crore and has been seeking a relief package from the government.

- Insolvency: if forced to pay AGR immediately, the companies could face insolvency which would have a severe ripple effect on the overall economy, as well as the overall service quality of all telcos.

The Culprit

'India’s statist politicians seem to assume that every sector is a cash cow for their welfarism, and that foreign investors can’t quit India. They had better think again. Aviation has already been decimated by state action; it looks like telecom is next, in spite of the fact that it is the backbone of any realistic growth strategy for India.'

It is notable that all the companies, other than the three- Jio, Airtel and Vodafone Idea- have either shut shop or are in insolvency process or are fighting cases against the Government in Courts or international Tribunals.

DoT pegs Bharti Airtel's dues at Rs 43,980 crore, that of Vodafone Idea Ltd. at Rs 58,254 crore and that of Tata Group at Rs 16,798 crore. Against this, Bharti self-assessed its dues at Rs 13,004 crore and paid a total of Rs 18,000 crore, including Rs 5,000 crore towards reconciling any difference. Vodafone Idea assessed its dues at Rs 21,533 crore and paid Rs 6,854 crore. Tata Group of companies.

The Duopoly

If in a worst-case scenario Vodafone Idea were to fail, customer options would dramatically shrink and the networks of the two remaining major carriers would be further overloaded, exacerbating patchy coverage and call drops common in India.

The duopoly of Jio-Airtel would not be in the interest of the country. India needs a healthy and competitive telecom sector. It would be in the national interest if Vodafone survives as a strong player. Any exit would hurt telecom gear makers such as Finland’s Nokia, Sweden’s Ericsson and China’s Huawei.

The Future and 5G

It is being reported that India’s telecom operators are planning to push back 5G network deployments to as late as 2025 due to high base price, lack of spectrum, and absence of any new bands for auction.

With the sector already reeling under heavy losses, in addition to the AGR payment obligations, it will be quite a while before 5G actually takes shape in the country. This will not just hurt our grandiose Digitial India program, but also make us dependent on China, which is light years ahead of us.

There are many questions which remain open, In the headlong rush to 5G, pause to ponder: How much capital invested in 4G will be destroyed? What happens to the outstanding debt of Rs 4.3 trillion? If an auction is held, can the domestic banking industry fund the requirements? Would a hasty auction end up helping only deep pockets and move the industry to a duo/monopoly?

The Conclusion

Telcos are a necessary part of any future consumer proposition, regardless of who owns the platform. The path forward is leveraging this strength while navigating the potholes of regulation, changing technology and consumer dynamics.

"Internet Is Meeting Room, Office Breaks With Colleagues History": PM

The paramount need is to restore a semblance of balance and impartiality to all regulatory decisions, be they of Trai or DoT. The purpose of regulating the industry was, inter alia, to “protect interests of service providers and promote and ensure orderly growth of the telecom sector”.

Centre should give some time to the telecom sector to emerge from their debts and should also rationalize the policies. Centre shouldn’t earn money from the telecom sector as such sectors are not meant from earning money. “These sectors are for providing services to people,”

Regrettably, this has been all but forgotten. This is a wake-up call to DoT.

#Telco #AGR #DOT #DigitalIndia #5G