Herfindahl-Hirschman Index: Rise & rise of Indian Telecom Market concentration

The Herfindahl-Hirschman Index (HHI) is a quantitative measure of market concentration that helps assess the level of competition within a specific market. It is commonly used in antitrust analysis and in evaluating the impact of mergers and acquisitions on market competitiveness. The HHI is calculated by summing the squares of the market shares of all firms operating in the market.

Let's do a business analysis of the current telecom sector in India and have a perspective on why the Government is still firm in operating BSNL even after incurring multi-year losses even in 2023.

First, some background:

The formula for calculating the Herfindahl-Hirschman Index is:

HHI = Σ(si)^2

Where:

HHI = Herfindahl-Hirschman Index

si = Market share of the ith firm in the market (expressed as a percentage)

A higher HHI value indicates a more concentrated market with fewer competitors, while a lower HHI value suggests a more competitive market with a greater number of firms.

Also,

- HHI < 0.01 indicates a highly competitive market

- HHI < 0.1 indicates an unconcentrated market

- 0.1 < HHI < 0.18 indicates moderate market concentration

- HHI > 0.18 indicates high market concentration

Now, let's look at some Indian company examples to illustrate the concept of the Herfindahl-Hirschman Index:

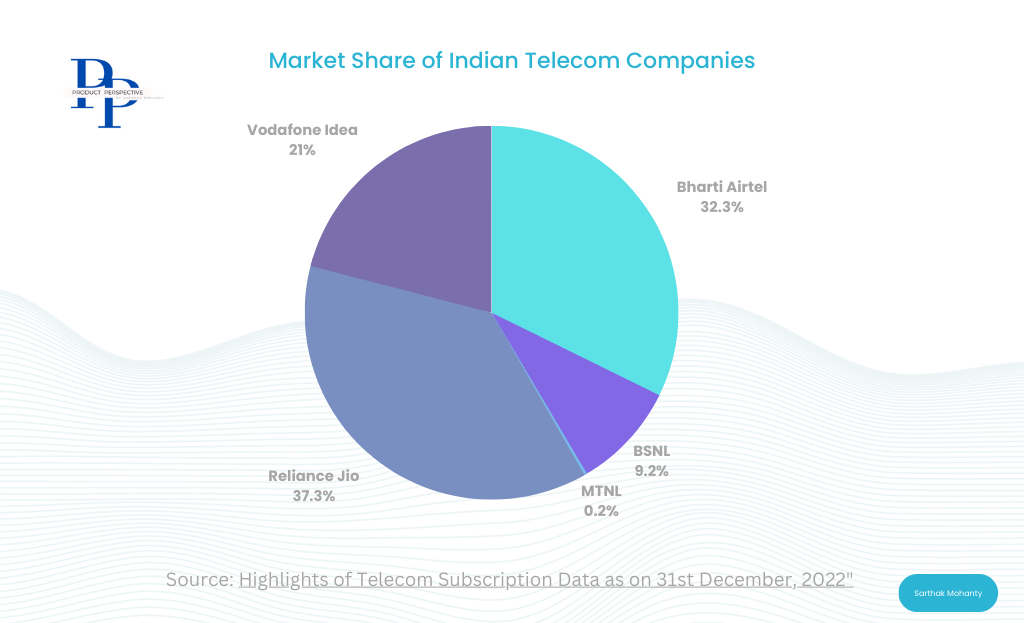

Data Source: TELECOM REGULATORY AUTHORITY OF INDIA. "Highlights of Telecom Subscription Data as on 31st December, 2022" (PDF).

Consider the Indian telecom industry, which has experienced significant changes and consolidation in recent years. Initially, there were several major players, but over time, some companies merged or exited the market.

Let's assume that Vodafone India and Idea which merged back in 2018 merged today in 2023, so the market shares of the top 6 telecom companies were as follows:

- Bharti Airtel: 32.3%

- Reliance Jio: 37.3%

- Vodafone India: 14%

- Idea: 7%

- BSNL: 9.2%

- MTNL: 0.2%

To calculate the HHI before the merger:

HHI = (0.323)^2 + (0.372)^2 + (0.14)^2 + (0.07)^2 + (0.092)^2 + (0.002)^2 = 0.104329 + 0.138384 + 0.0196 + 0.0049 + 0.008464 + 0.0016 = 0.277277

After the merger of Idea and Vodafone India, their combined market share became 21%. The market share of other companies remains the same.

To calculate the HHI after the merger:

HHI = (0.323)^2 + (0.372)^2 + (0.21)^2 + (0.092)^2 + (0.002)^2 = 0.104329 + 0.138384 + 0.0441 + 0.008464 + 0.0016 = 0.296877

Comparing the HHI before and after the merger, we can see that the HHI increased from 0.277277 to 0.296877. This indicates a rise in market concentration, suggesting that the telecom market (which was already highly concentrated as per the index) became more concentrated with fewer competitors after the merger. Therefore if BSNL (or Vodafone Idea) books its losses and exits the market, the common man is eventually going to suffer due to the lack of a firm competitive market.

Sales / JSW BPSL | Executive PG Diploma @ XIMB, Bhubaneswar

9moVery correctly said Sarthak Mohanty. That’s the beauty of doing business because with fewer players in the market, customer looses prices because market transition from buyer price market to seller price market where seller determines the prices. Also, another important point is that with fewer service providers, seller enjoys higher market share but on the perspective of innovation moves out of board table as they know they are on higher market share or players are few leading to cartelised initiatives among the corporates. On customer perspective, it is very bad as key to remain competitive in the market drives innovation in the service or goods. Good to know that as an member of XIM Alumni Committee, you have started analysing the concepts taught to us in real business analysis. Very proud of you, dear.