The state of Pará in Brazil is one of the most important mining regions in the nation, featuring large-scale extraction of minerals such as gold, copper, and iron. Mining is one of the most important economic activities in the state, generating revenues of more than R$ 90 billion per year and representing more than 80% of the state’s exports. Therefore, ensuring that the rents from mining activities in the region promote development and improve the quality of life for the local communities is a key public policy challenge.

But transforming mineral wealth into local prosperity is not simple. Most studies of natural resource effects on development show that well-resourced regions around the world too often fail to promote socioeconomic development. This failure can be traced to weak institutional environments that prevent governments from adequately taxing and investing mining rents to promote sustainable economic growth.

In this insight brief, researchers from Climate Policy Initiative/Pontifical Catholic University of Rio de Janeiro (CPI/PUC-Rio) present evidence of the relationship between mining royalties and development in the state of Pará, Brazil. Because mining royalties represent the primary opportunity for revenue and investment to flow back to Pará, examining them in detail provides a critical look at how the government creates economic opportunities in the region and how it could be improved.

RECOMMENDATIONS

• Regulations must define and clearly limit the areas where mining royalties can be spent. The legislation establishing the distribution of Financial Compensation for the Exploration of Mineral Resources (Compensação Financeira pela Exploração de Recursos Minerais – CFEM) intended for the mining royalties to be invested in environmental quality, health, and education infrastructure. Nonetheless, the CPI/PUC-Rio analysis of CFEM data shows that when municipalities receive increases in mining royalties, they translate to greater increases in wages and pensions than in health or education infrastructure. This result does not align with the legislation’s royalty distribution requirements and indicates that reforms are needed to ensure royalties get invested to improve local infrastructure and public services.

• Solutions to help municipalities to reduce the variability in mining royalties must be created. Royalties are tied to mining product prices and therefore are very volatile. This volatility hurts local governments’ ability to plan and implement long-run investments. Creating financial instruments that enable municipalities to reduce the variability of their royalty revenues (as is often done at the national level) is therefore important to increasing the efficiency of royalty expenditures. For example, a CFEM resource fund could smooth price variability over time and across different municipal administrations.

Overview of Sources of Mining Royalties in Pará and Their Geographical Distribution

The Financial Compensation for the Exploration of Mineral Resources (Compensação Financeira pela Exploração de Recursos Minerais – CFEM) established the main mining royalties, which are received through a tax and distributed to local governments in Brazil. CFEM was created by the 1988 Constitution as a mechanism to compensate local governments for the impact of mining activities.[1] This compensation mechanism is a product-specific tax over net sales of mining establishments. The maximum percent charged for CFEM has varied between 3% and 4% over time.[2],[3],[4] The compensation’s governmental destination has also varied over time, but in the most recent legislation, 75% is designated for municipalities, 15% to the states, and 10% to the federal government.[5],[6]

The National Mining Agency (Agência Nacional de Mineração – ANM) manages CFEM. Based on ANM royalty data from 2007 to 2020, CFEM transferred R$ 8.5 billion (US$ 1.5 billion) to the municipalities of the state of Pará. Most of CFEM revenues come from iron extraction followed by copper and bauxite (Figure 1A). The extraction of these products is heavily concentrated within the municipalities of Parauapebas and Canaã dos Carajás, which have important operations focused on iron and copper extraction, respectively. Parauapebas and Canaã dos Carajás received 80% of all mining royalties during the period (Figure 1B). Other municipalities that received significant amounts of royalties per capita include Marabá (main product: copper), Itaituba and Novo Progresso (gold), Paragominas and Oriximiná (bauxite), and Curionópolis and Terra Santa. These nine municipalities are concentrated in three geographical clusters (Figure 2).

Figure 1. Distribution of Royalties by Mining Product and Municipality, 2007 – 2020

Source: CPI/PUC-Rio with data from the National Mining Agency (Agência Nacional de Mineração – ANM), 2022

Figure 2. Top Nine Municipalities Receiving Mining Royalties (per capita), 2007 – 2020

Source: CPI/PUC-Rio with data from the National Mining Agency (Agência Nacional de Mineração – ANM), 2022

Over time, the number of municipalities receiving royalties has increased (Figure 3). However, most of the municipalities that more recently began receiving mining royalties typically receive less than R$ 50 per person, while more consolidated areas of mining receive more than R$ 500 per person. This means that royalty distribution remains concentrated in the same municipalities that have historically received more royalties.

Figure 03. Distribution of Mining Royalties (per capita) in 2007 and 2020

Source: CPI/PUC-Rio with data from the National Mining Agency (Agência Nacional de Mineração – ANM), 2022

Municipalities Heavily Dependent on Mining Royalties Face Fiscal Vulnerability

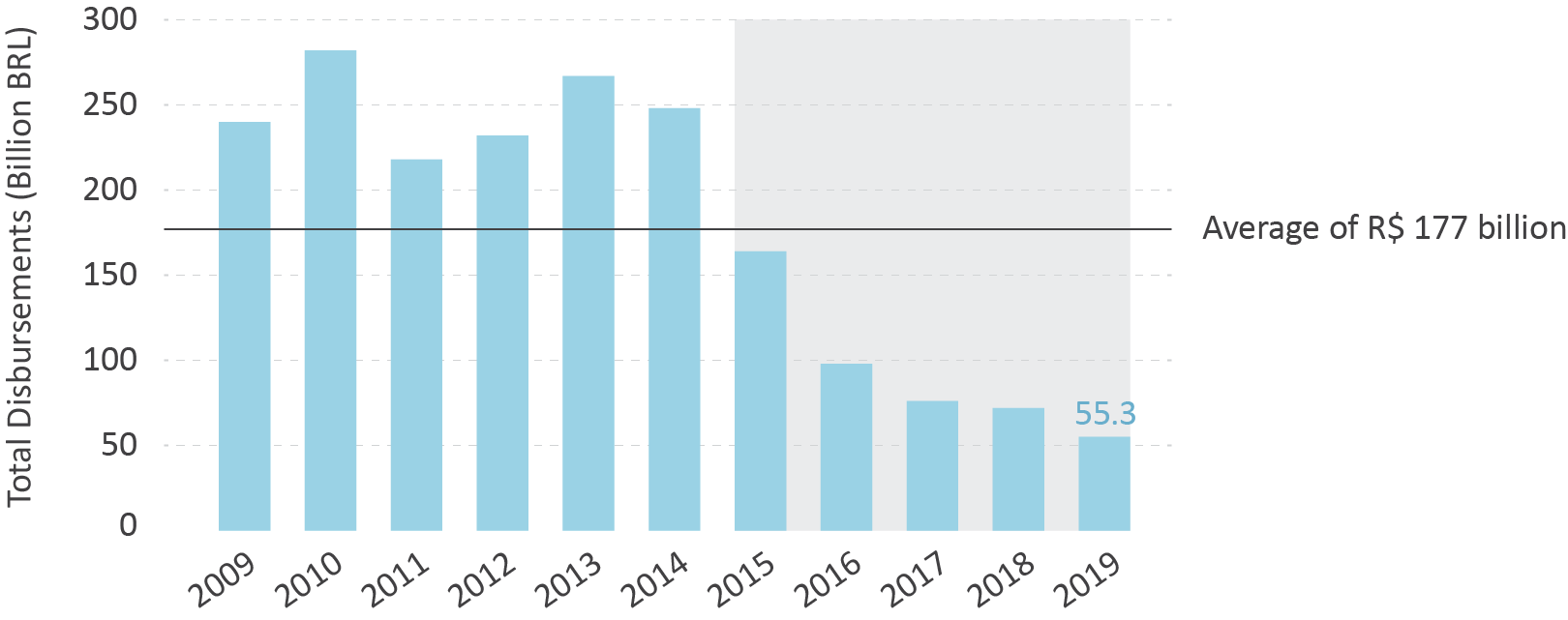

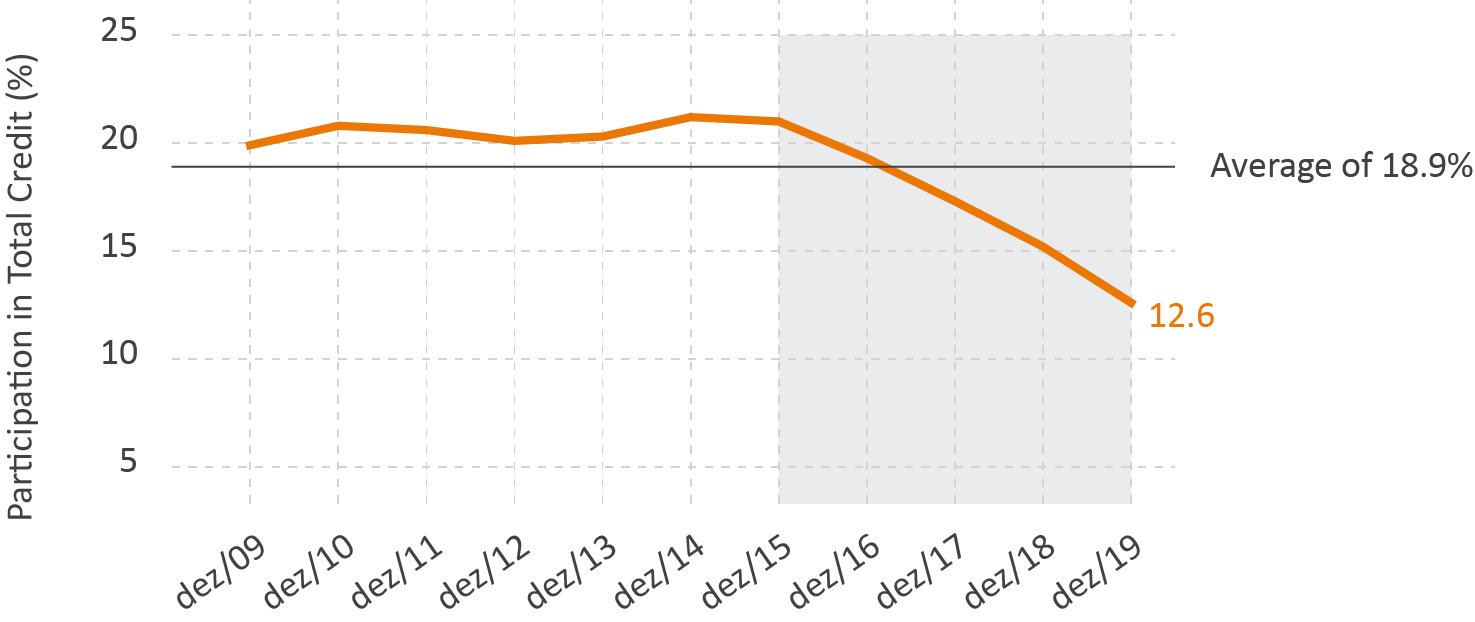

The price of mining products fluctuates significantly. Because royalties are tied to mining revenues, this means that royalties also fluctuate significantly. This variability can create fiscal vulnerability for municipalities that depend heavily on royalties to fund their government services. Data from Brazil’s Treasury indicate that royalties represent 63% of fiscal revenues in Canaã dos Carajás, 40% in Parauapebas, and around 20% in Oriximiná, Curionópolis, and Terra Santa, making these areas especially vulnerable to changes in mining prices.

Mining price volatility presents challenges for fiscal planning, especially when governments do not have the ability to reallocate financial resources across fiscal years. The result is that governments may be forced to spend their royalties on short-term rather than long-term investments. Financial instruments that allow governments to smooth variations in fiscal revenues, especially across fiscal years, would help overcome this challenge.

The evidence: Mining royalty expenditures in Pará most often directed to wages and pensions rather than socioeconomic development

Natural resources and strong socioeconomic development require strong institutions to make effective decisions about how mining royalties will be spent, research shows. The CPI/PUC-Rio analysis of mining royalties in all municipalities of Pará shows that an increase of R$ 1 in mining royalties is associated with an equal increase in municipal expenditure. Since the local economic activity should increase alongside royalties, tax revenues and expenditure should also increase. The lack of a higher increase in expenditure suggests that fiscal effort decreases as mining royalties increase. That is, as royalties increase, municipalities can reduce tax rates or reduce resources and personnel allocated to identify tax debtors and collect tax debts.

The analysis also shows that one half of the increase in mining royalties is diverted to current expenses (mainly wages and pensions) and the other half to investments. These observed expenditure increases are at odds with the goals outlined in the regulation of mining royalties. As stated by the ANM:

“The resources originated from CFEM cannot be applied in debt payment or in the permanent staff of the Union, States, Federal District and Municipalities.”[7]

Nevertheless, the data show that governments prioritize wages and pensions when they distribute mining royalties. When expenditures are broken down by type (wages/pensions, health, education, transportation, and housing), the CPI/PUC-Rio analysis shows that, after wages and pensions, the increases in royalties translate to increased expenditures in health and education (roughly 40 cents to each additional R$ 1 in royalties) followed by transportation and housing (roughly 10 cents for each additional R$ 1 in royalties).

Figure 4. Estimates of the Relation Between Mining Royalties and Public Expenditure

Source: CPI/PUC-Rio with data from National Mining Agency (Agência Nacional de Mineração – ANM) and Treasury of Brazil, 2022

These results show that municipalities find ways to create budget adjustments that prioritize wages and pensions, as well as other expenditure types, and that overall governments do not spend mining royalties in alignment with CFEM regulations.

Despite increasing public expenditures in municipalities that benefit from mining royalties, CPI/PUC-Rio’s analysis does not show increased local development as CFEM intends. According to a municipal development index, royalties do not improve municipal development or its individual components (i.e., education, health, and income). The royalties only effect is to reduce violence, but this reduction is modest. An increase of R$ 500 in royalties per capita is estimated to reduce the homicide rate by 1.1 deaths per 100,000 people, about 2% of the state homicide rate in recent years. This analysis aligns with other research in the field that shows rents from the extraction of natural resources often fail to foster significant development.

Why mining royalties do not generate socioeconomic development: Insights for policymakers and stakeholders

The evidence presented by the CPI/PUC-Rio analysis shows that the state of Pará faces challenges in transforming mining royalties into tangible improvements in development. This corresponds with more general trends from around the world. A review of economic literature on the relationship between mining and development points to key challenges that the State will need to address.

The main mechanism explaining the absence of economic development in mining regions relates to the presence of weak institutions. A seminal work shows the exploration of natural resources will only sustainably increase welfare if societies invest a substantial share of the income generated by resource extraction in reproducible physical and human capital.[8] Absent this investment, a decrease in welfare is inevitable as natural resources are depleted. This result points to the importance of taxing natural resources extraction and investing these tax revenues effectively. Nevertheless, in a weak institutional environment, governments might lack the capacity to tax income from natural resources or spend the resources adequately, inhibiting sustainable economic development.

The evidence of the effects of oil rents on Brazil is consistent with this idea. After a legal change affected the petroleum royalties of Brazilian municipalities, the economic production of regions that increased its share of royalties grew less than the production of non-affected ones. Oil rents reduce fiscal and tax efforts.[9],[10],[11] There are conflicted results for the effect of oil rents on some social indicators, such as, access to electric wiring, piped water, waste collection, and illiteracy rate.[12] Social spending, infrastructure, and income increase less than expected given the higher reported spending.[13]

For the mining sector, there is evidence that natural resource wealth promotes economic development in districts in India.[14] Mineral rents caused the election of politicians charged with serious crimes.[15] This finding shows how resource extraction can interact with weak institutions, promoting rent seeking and corruption.

The most closely related work for mining income effects in Brazil analyses the mining royalties for states of Pará and Minas Gerais in Brazil, finding that eligible municipalities reduce their fiscal effort, increase hiring in the public sector, and increase public spending more than the increase in the per capita income.[16]

The CPI/PUC-Rio analysis of mining royalties in Pará did not disentangle effects of legal and illegal activities. This is an important caveat since besides fiscal, growth, and corruption concerns, the presence of natural resources and their illegal exploitation might also influence violence. For example, evidence of increasing violence connected with mining activities in Africa and similar evidence specifically for Congo.[17],[18] For Brazil, a change in fiscal accountability for the mining sector in Brazil increased the use of violence near illegal gold-mining sites.[19]

Taken together, most of the literature indicates that revenues from resource extraction are often poorly spent, being captured by local special interests and corrupt politicians. This often offsets the economic benefits from resource extraction, in particular in the long run.

Conclusion

Mining is one of the most important economic activities in the state of Pará, generating revenues of more than R$ 90 billion per year and representing more than 80% of the state exports. In this insight, CPI/PUC-Rio researchers provide evidence that the royalties mining companies pay to local governments do not foster economic growth nor increase welfare of local communities. Rather, the royalties are mainly targeted to increasing wages and pensions. While not uncommon in other countries and sectors, these results suggest the urgency of reforming the Brazil’s governance and destination of mining royalties to ensure they benefit local populations.

The State of Pará has a unique opportunity to make sustainable investments. However, to do so the goals of investment need to be clear – reproducible physical and human capital. There must be transparency along with the strong institutional frameworks to tax natural resources extraction and adequately invest these tax revenues.

Specifically, the analysis points to two recommendations: Regulation must define and clearly limit the areas where mining royalties can be spent. Second, solutions to help municipalities to reduce the variability in mining royalties must be created.

[1] Casa Civil. Law no. 7.990. December 28, 1989. bit.ly/39tcCNm.

[2] Casa Civil. Law no. 8.001. March 13, 1990. bit.ly/3LeeIhn.

[3] Secretaria-Geral, Subchefia para Assuntos Jurídicos. Provisional Measure no. 789. July 25, 2017. bit.ly/3wiyZOB.

[4] Secretaria-Geral, Subchefia para Assuntos Jurídicos. Law no. 13.540. December 18, 2017. bit.ly/3LqV7uM.

[5] Ibid.

[6] For a previous distribution of CFEM where 45% was directed to the states and 45% to the municipalities, see: Casa Civil. Law no. 8.001. March 13, 1990. bit.ly/39nmqbU.

[7] Agência Nacional de Mineração. Perguntas Frequentes. bit.ly/3w6HrRe.

[8] Hartwick, John M. “Intergenerational equity and the investing of rents from exhaustible resources”. In The Economics of Sustainability, 63-65. Routledge, 2017.

[9] Postali, Fernando Antonio Slaibe. “Petroleum royalties and regional development in Brazil: The economic growth of recipient towns”. Resources Policy 34, no. 4 (2009): 205-213.

[10] Postali, Fernando, and Fabiana Rocha. Resource Windfalls, Fiscal Effort and Public Spending: Evidence from Brazilian Municipalities. SSRN, 2009. bit.ly/3FNQXvu.

[11] Postali, Fernando Antonio Slaibe. “Tax effort and oil royalties in the Brazilian municipalities”. Economia 16, no. 3 (2015): 395-405.

[12] Postali, Fernando Antonio Slaibe, and Marislei Nishijima. “Oil windfalls in Brazil and their long-run social impacts”. Resources Policy 38, no. 1 (2013): 94-101.

[13] Caselli, Francesco, and Guy Michaels. “Do oil windfalls improve living standards? Evidence from Brazil”. American Economic Journal: Applied Economics 5, no. 1 (2013): 208-238.

[14] Asher, Sam, and Paul Novosad. Digging for development: Mining booms and local economic development in India. Oxford University, 2014. bit.ly/3LqVQw0.

[15] Asher, Sam, and Paul Novosad. “Rent-seeking and criminal politicians: Evidence from mining booms”. The Review of Economics and Statistics (2018): 1-44.

[16] Brasil, Eric Universo Rodrigues. “O novo código de mineração no Brasil: uma análise econômica da compensação financeira sobre a exploração dos recursos”. PhD thesis., Universidade de São Paulo, 2016.

[17] Stoop, Nik, Marijke Verpoorten and Peter Van Der Windt. “Artisanal or industrial conflict minerals? Evidence from Eastern Congo”. World Development 122 (2019): 660-674.

[18] Berman, Nicolas, Mathieu Couttenier, Dominic Rohner and Mathias Thoenig. “This mine is mine! How minerals fuel conflicts in Africa”. American Economic Review 107, no. 6 (2017): 1564-1610.

[19] Pereira, Leila and Rafael Pucci. A Tale of Gold and Blood: The Unintended Consequences of Market Regulation on Local Violence. Working Paper 005. Rio de Janeiro: Climate Policy Initiative, 2021. bit.ly/3LhmxTB.