- News

- Business News

- India Business News

- India’s $40bn FDI pips China’s $33bn in 2018

Trending

This story is from December 29, 2018

India’s $40bn FDI pips China’s $33bn in 2018

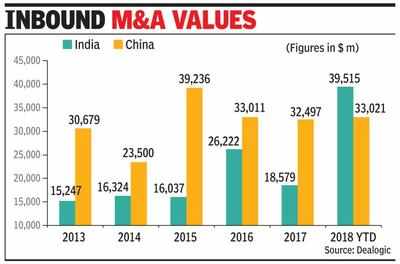

Mumbai: For the first time in years, annual foreign direct investment (FDI) into India has been more than that in China in 2018.

Riding on mega deals by Walmart’s buyout of homegrown online retail market place Flipkart, along with acquisitions by Unilever and Schneider Electric, the year that will end soon has recorded inbound M&A deals worth $39.5 billion in India, compared to $33 billion in China, data from Dealogic showed.Interestingly, in 2017, China’s inbound M&A deals aggregated at $32.5 billion, which was almost 80% more than India’s $18.6 billion.

For India, relatively stable economic fundamentals with low inflation rate, strict management of fiscal deficits and introduction of a bankruptcy code boosted the country as an investment destination among global investors. On the other hand, for China, the ensuing trade war with the US is keeping foreign investors on the back foot, market players said. The trade war is also taking a toll on China’s stock market where its leading benchmark, the Shanghai Composite, has lost about a quarter of its value this year compared to a 6% rise in sensex in India.

Going into 2019, foreign investors feel India will still remain an attractive investment destination. Foreign broking major Credit Suisse (CS) said its analysts preferred investments as a theme over consumption. “This decade industrials have underperformed by 48%. In recent years, they have lagged despite steady earnings growth. Improving relative price/earnings ration as markets gain confidence in the investment cycle sustaining should drive significant outperformance,” CS’s India strategy report said.

Riding on mega deals by Walmart’s buyout of homegrown online retail market place Flipkart, along with acquisitions by Unilever and Schneider Electric, the year that will end soon has recorded inbound M&A deals worth $39.5 billion in India, compared to $33 billion in China, data from Dealogic showed.Interestingly, in 2017, China’s inbound M&A deals aggregated at $32.5 billion, which was almost 80% more than India’s $18.6 billion.

For India, relatively stable economic fundamentals with low inflation rate, strict management of fiscal deficits and introduction of a bankruptcy code boosted the country as an investment destination among global investors. On the other hand, for China, the ensuing trade war with the US is keeping foreign investors on the back foot, market players said. The trade war is also taking a toll on China’s stock market where its leading benchmark, the Shanghai Composite, has lost about a quarter of its value this year compared to a 6% rise in sensex in India.

Going into 2019, foreign investors feel India will still remain an attractive investment destination. Foreign broking major Credit Suisse (CS) said its analysts preferred investments as a theme over consumption. “This decade industrials have underperformed by 48%. In recent years, they have lagged despite steady earnings growth. Improving relative price/earnings ration as markets gain confidence in the investment cycle sustaining should drive significant outperformance,” CS’s India strategy report said.

End of Article

FOLLOW US ON SOCIAL MEDIA