With so many zeros to deal with (I’m talking about the numbers here, not the politicians) government finance can seem complex, but it’s actually pretty simple. Let’s take a look at the figures for 2011.

According to the following charts the United States government received $2.3 trillion in tax revenue and it spent $3.6 trillion on stuff. Now let’s see… $2.3 trillion in income – $3.6 trillion in expenses = a $1.3 trillion dollar budget deficit for 2011. That’s $1,300,000,000,000 with all the zeros. Simple!

Money coming in:

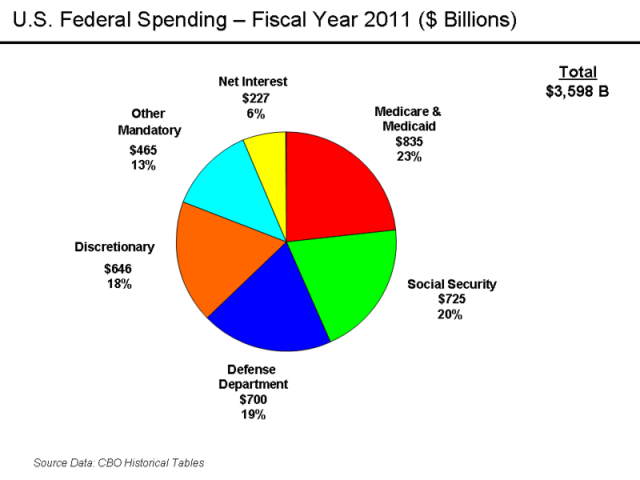

And money going out:

Naturally this leads to questions like:

- How can the government afford to run a $1.3 trillion dollar annual budget deficit?

The short answer is the government borrows the money. It finances it’s deficits, year after year, and it’s no secret the government’s accumulated debt has now grown very large. In fact, size of the government’s debt has become the subject of considerable debate; according to the government’s numbers the Federal debt is $15.6 trillion dollars but some folks (myself included) would argue that to properly account for the government’s liabilities you’ve got to include unfunded social security, medicare and medicaid obligations. If we include these unfunded obligations one could argue that the total debt is really much closer to $100 trillion, but we’ll set that line of reasoning aside for now and just focus on the government’s $15.6 trillion dollar figure.

Here’s a chart of the national debt from a year and a half ago, when the debt was *only* $13.5 trillion, but I think it still does a good job of getting the point across:

Now remember, since the above chart was produced the government has added another $2 trillion to the debt! Truly, the accelerating rate at which the debt is growing is alarming and one can only wonder at how large the debt will become over the next few years. This brings to mind even more questions like:

- Who’s lending the government the money? How long can this continue?

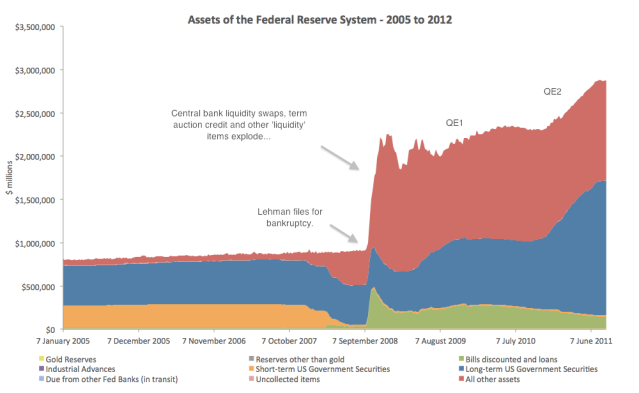

In the not so distant past the “who” was domestic and foreign investors, and foreign governments. As money was sent from the United States to Asia for manufactured goods and to the middle east for oil, these exported dollars were recycled back to the United States through the purchase of United States Treasuries (financing the government’s debt), and mortgage securities (fueling the housing bubble) but ever since the big slow down in 2007 foreign money isn’t flowing like it used to and we’ve increasingly relied upon our private central bank, the Federal Reserve, to finance our debt.

That’s quite an expansion of the balance sheet ya’ got there Ben.

Because the privately owned Federal Reserve has been so “accommodative” with its monetary policy the interest rate on United States government debt has remained very low, presently in the 0 to 3% range depending on duration. As for how long government finance can continue in this fashion…it depends.

If present trends continue it seems certain that the interest on the government’s accumulated debt will eventually consume all of the government’s tax revenue and this will indeed be an interesting development. The present trends are; falling tax revenues due to a weak economy, increases in social security, medicare and medicaid pay-outs as the baby boom demographic moves into retirement, and the rapidly growing principal on the Federal debt.

But what about interest rates, the debt service on the debt? Let’s run a few calculations based on the official $15.6 trillion dollar Federal debt (as of March 2012):

- At the current rate of roughly 2% the annual interest on the federal debt is $308 billion dollars, a little over 13% of 2011 government revenues.

- At a modest rate of 5% the annual interest on the federal debt would be $770 billion dollars, a little over 33% of 2011 government revenues. Interestingly, looking at the government expenditure chart above, $770 billion in interest + $725 billion for social security + $835 billion for medicare & medicaid = $2.3 trillion dollars. Thus at 5%, interest on the national debt + social security + medicare & medicaid = 100% of government revenues!

- At a rate of 15% (the current average rate for credit cards) the annual interest on the $15.6 trillion dollar debt would be $2.3 trillion. At 15% the interest on the debt alone would be 100% of the government’s tax revenue.

“Insanity is doing the same thing over and over again but expecting different results.”

The above quote is commonly attributed to Albert Einstein and I’ve often thought of it while fishing on a slow day, but it applies equally as well to the financial situation. Clearly, the solution to the world-wide debt crisis will not be found by continuing the same policies, advanced by the same people, that got us into this mess.

Sooner or later we as a society will be forced to deal with this issue. Unfortunately, as it stands now, we can expect our political and financial leaders to continue framing the problem in terms of taxing, spending, and borrowing (credit creation!) but this is merely a continuation of the same kind of thinking that created the mess we’re in. The real questions that must be addressed are:

What is money? Why does the government borrow money when it has the power to create debt-free money? Who benefits? Why must humanity serve the debt-based monetary system? Shouldn’t it be the other way around, shouldn’t the monetary system serve humanity?

Clearly, a new monetary system is called for and the clock is ticking…

The good news is there are alternatives and I hope to explore some of them in future posts.

In the mean time here’s an interesting video on the subject by a Professor from Duquesne University. While I don’t completely agree with his math or idea that the debt can be repaid (because, under our current debt-based monetary system, as debt is repaid money is extinguished. Deflation baby!) he at least does a good job of outlining the problem.

Pingback: Medicare / Medicaid and the rule of 72 | Richard Gessford Blog