Abstract

The existence of behavioural bias such as positive feedback trading (PFT) and herding is well researched for advanced economies. This paper explores whether foreign institutional investors (FIIs), a prominent investor group, pursue these strategies in India. The contribution lies in the application of multiple measures of herding. Results indicate that FIIs exhibit PFT behaviour in equity and to some extent, in debt. At the individual stock level, FIIs herd during non-extreme market conditions, but market-level measures indicate absence of herding in extreme market conditions. In the bullish market, they behave more rationally compared to bearish or normal market conditions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The strategies of investors in financial markets constitute an interesting area for study. Investment behaviour studied in the literature points to strategies like positive feedback trading (PFT) and herding. While PFT refers to buying an asset when prices rise and vice-versa, herding is about the tendency of mimicking the actions of others. PFT is quite common in developed and emerging markets alike. Herding also is a strategy observed in financial markets, involving a particular investor group like mutual fund managers, financial analysts or even individuals. In a market with large institutional investors, such behaviour is more pertinent.

While theoretical research on herding pertains to finding out the causes and implications, empirical research focuses on gauging whether clustering of decisions at a particular time is taking place (Wang, 2008). Hirshleifer (2001) observes that individuals often make influenced judgments under ambiguity. They imitate the behaviour of other investor group/s due to lack of time and cognitive resource differences. Interestingly, herding may be construed as a rational as well as an irrational behaviour. If the investor completely disregards her prior beliefs and blindly follows other investors, it is irrational (Devenow & Welch, 1996). But if the investor mimics the actions of others without taking into account their own private information due to concerns for reputation or for having incomplete information, it is called rational herd behaviour (Bikhchandani & Sharma, 2000).

Investors’ behavioural bias is evident from the fact that they buy securities in a rising market and sell them in a falling market, which is referred to as PFT. Bikhchandani and Sharma (2000) call this a momentum-based technique. This strategy attempts to intensify price movements and augments volatility. De Long et al. (1990) show how speculators engage in PFT and how this may destabilize price. The interaction of informed rational speculators who drive up prices without the support of fundamentals and the positive feedback traders who purchase at heightened prices leads to price destabilization.

Regarding the presence of PFT and herding, empirical research exhibits mixed evidence. For example, Lakonishok et al. (1992), report the absence of herding or feedback trading among pension fund managers in the U.S. during 1985–1989. In contrast, Choe et al. (1999) observe the presence of PFT and herding by the foreign institutional investors (FIIs) before the Asian currency crisis in 1997 in South Korea. Nofsinger and Sias (1999) find that FIIs influence the stock return more than the individual traders by way of intra-day PFT. For herding also, evidence is mixed. For instance, Gleason et al. (2004), report the absence of herding during extreme market fluctuation periods in American exchange, while Caparrelli et al. (2004), observe the presence of herding and nonlinearity in herding pattern in Italy. Demirer et al. (2019) document that the US market shifts to a state of herding just before the Flash Crash of 2010 and continues at the same state during and after the event. Similarly, few studies explore herding in the context of the financial crisis (for instance, Bekiros et al., 2017) provide evidence of intense herding during extreme market conditions. However, Galariotis et al. (2016) find evidence of herd behaviour in European government bond prices. Studies find the existence of herding under extreme market conditions in the Indian and Chinese stock markets (Lao & Singh, 2011), in Portuguese, Spanish, Greek and Italian stock markets (Economou et al., 2010), and also in the cross-border market (Andrikopoulos et al., 2017) and cryptocurrency market (Stavroyiannis & Babalos, 2019).

A limited number of studies have explored trading behaviour in India so far. After the opening up of capital markets in the 1990s portfolio investors have made India one of their favourite destinations, along with some other Asian emerging economies, owing to much higher returns with more or less similar risk compared to developed markets (Mukherjee et al., 2002). So, the importance of such investors in driving equity market return is widely studied. Most of them observe the existence of PFT in the last two decades, while results on herding are mixed. Given the importance of such investors and the potentially destabilizing effect their trades might have, it is pertinent to examine whether such portfolio investors undertake herding or PFT in an emerging market like India in the recent past.

Considering this backdrop, this study tries to determine whether the FIIs that includes mutual funds, insurance companies etc. trading in the Indian secondary capital markets in equity and debt, are adopting the two trading strategies. This may immensely benefit policymakers and traders.

There are many ways to measure herding and the studies on India have applied some of them. Moreover, the studies are mostly based on low-frequency data that may not capture the trading behaviour properly. Studies are quite dated, too, especially in the context where the financial sector has been emerging quite fast. This paper tries to fill the gap by testing for PFT at the aggregate level and the presence of herding by FIIs at the individual stock and market level based on daily data. It contributes to the existing body of literature by considering high-frequency data in the recent past and by adopting a comprehensive approach in measuring herding in the Indian context.

The results suggest that the FIIs adopt both herding and PFT. Interestingly, herding does not exist under extreme market conditions. This supports a rational asset pricing mechanism during market stress. To the best of our knowledge, this study is by far the most comprehensive one concerning India that tries to capture investment behaviour under normal and stressed or extreme market conditions, by using both stock and market-level measures of herding and taking into account the possibility of asymmetry in behaviour during bullish vis-à-vis bearish market conditions.

The structure of the remaining paper is as follows: Sect. 2 reviews the existing literature. Section 3 describes the data and methodology of the study followed by the empirical findings in Sect. 4. Section 5 concludes the paper.

2 Literature Review

FIIs were allowed to trade in the Indian bourses in 1992 and since then India has become one of the major destinations of such investors. Therefore, we describe the emergence and role of FIIs in India in the first subsection. The other subsection documents evidence on PFT and herding based on different measures.

2.1 The Role of Foreign Institutional Investors in India

A general perception about the FIIs is that they behave like speculators. FIIs engage in herding and PFT to achieve the short term goal of making quick profits (Chandra, 2012). In emerging economies, the equity markets lack width and depth and are vulnerable to fluctuations in the FII flows who may willfully withdraw a large amount, even if the fundamentals of the economy do not warrant such action. At times, international investors make frequent marginal adjustments to their portfolios by using ‘quick exit’ to contain downside risk and thereby spread crisis even to countries with strong fundamentals. This is because the changes in portfolios are often due to change in perceptions of international investors on country solvency rather than the actual variations in underlying asset value (Fitzgerald, 1999). In a study conducted in the Korean market, evidence shows that foreign investment induces greater volatility to markets compared to domestic investors (Jo, 2002). Focusing on the Indian stock market, Garg and Mitra (2015) find the existence of unintentional herding among FIIs causing short-term volatility in the market. The study focuses on the investors’ excess buy over sales relative to the total value traded as an indicator of herding, and the estimation is based on vector autoregression (VAR) model.

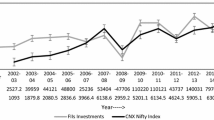

In India, registration of 9556 FIIs with a holding of INR 33.42 million as of 31st March, 2019, compared to 14.27 million on 2009–2010 is reported.Footnote 1 The role of FIIs in the Indian financial market assumed considerable significance over the decades. Foreign portfolio investment (FPI) over the past decade has touched INR 27,000 million (Figure 1). Also, total FPI as a proportion of turnover at the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) remained at 2.5% on an average, while it was 5.4% in 2014–15. According to the Global Financial Stability Report (2020) of the International Monetary Fund, foreign participation in equity markets is significant in some emerging market economies including India. International investment in equity as a percentage of market capitalization in the second quarter of 2019 was at around 10% for China, India and Chile, while it was higher, at around 30% for Brazil and Russia. This points to the importance of FIIs in the Indian stock markets.

The growing importance of FIIs may also be understood from the studies that estimate the impact of FIIs on stock returns and other macroeconomic variables. The evidence is quite mixed. Gordon and Gupta (2003) observe that lagged stock market return and changes in credit ratings are the determinants of the portfolio flows. Mukherjee et al. (2002) suggest that growth of the Indian market and higher returns with more or less the similar risk offered by the market have attracted FII inflows into India. Ananthanarayanan et al. (2009) and Patnaik and Shah (2006) conclude that FPI flows are not responsible for destabilizing the Indian market. However, Dhingra et al. (2016) and Garg et al. (2016) highlight the destabilizing effect of FIIs in the Indian stock market by studying the institutional herding at market level and individual stock level, respectively. After the Asian financial crisis of 1997, FIIs have been viewed as a destabilising agent as it is observed that the trading behaviour of foreign investors was highly correlated (Erb et al., 1994; Solnik et al., 1996). They exhibit herding and had the potential of creating a sense of panic as and when they enter or exit a market. However, Chattopadhyay et al. (2018) predict this herding pattern of FIIs in India successfully with sophisticated data mining techniques. According to them, herding in India can be forecasted accurately using superior algorithms. Based on the FIIs daily trading data in the Indian financial market, the study reveals their tendency to herd. Using the LSV model the study confirms the presence of herding. Herding persistence is measured by considering the herding ratios in highly traded individual stocks. It further explores the possibility of predicting herding in individual stocks using seven suitable data mining techniques

2.2 Evidence on Trading Behaviour of FIIs

Herding behaviour is defined as buying or selling the same stock as the other managers do at the same time (Lakonishok et al., 1992). Bikhchandani and Sharma (2000) opine that investors’ intent to replicate the behaviour of other traders is an act of herding. According to Chang et al. (2000), rational decision making is foregone while pursuing herd behaviour. Further, it leads to mispricing of securities by the use of biased opinions of risk and expected return. The institutional investors, among others, pursue such trading practices as they seek to maintain or gain reputation by following the trade of other fund managers and gathering information from each other’s actions.

Herding in different markets may exhibit different patterns. For example, Hudson et al. (2020) find evidence that fund managers of the UK herd based on investors’ sentiment. In a study on Asian and Latin American markets, Kabir et al. (2018) observe that while some markets have a tendency of herding with market consensus in the high market regime, there is no such nonlinearity in market regimes in China, India, Brazil, Singapore, Malaysia etc. Interestingly, investors in most of the market’s herd in high volatility regime and the main driving factor in herding are the high volatility and not the low return during the market stress. Ah Mand and Sifat (2021), for Malaysian stock market data from 1995 to 2016, employed a two-state Markov Switching model and observe that herding is largely regime-dependent and a non-linear phenomenon. Using the Hwang and Salmon (2004) measure, Fei and Liu (2021) observe the existence of both positive and adverse herding in China.

Nofsinger and Sias (1999) detect that institutional investors have a larger impact on the stock returns by exhibiting herding in the form of change in ownership along with intra-year positive feedback behaviour, compared to individual investors. Bonser-Neal et al. (2002) report that the foreign investors display trade based herding and PFT in Indonesia from 1995 to 2000. Further, such trading behaviour does not destabilise stock prices during the Asian crisis. In contrast, Onishchenko and Ülkü (2019) explore the Korean market and conclude that FIIs change their trading styles over time and shift from positive to negative feedback trading. Similar evidence of negative feedback trading has been spotted in European emerging stock markets too (Ülkü, 2015). Grinblatt et al. (1995) find a significant level of herding and PFT behaviour exhibited by the 155 US mutual fund managers and that funds also gained substantial abnormal return by following momentum strategies. Very recently, Marfatia (2021) and Zhang et al. (2021) reveal the presence of PFT by FIIs in India and at least in ten sectors of China, respectively, during the COVID-19 pandemic.

Khanna (2002) finds no evidence of PFT or herding of FIIs on the Indian markets for the period of 1990 to 2001. The studies conducted by Chakrabarti (2001), Mukherjee et al. (2002) and Garg and Bodla (2011) evaluate the impact of FIIs on the Indian stock returns and find mixed evidence on PFT. Chakrabarti (2001) observes that the FII flow is not a cause but an effect of equity return implying PFT, whereas Mukherjee et al. (2002) show that causality exists in both directions. More recent studies also find evidence of PFT for FIIs (e.g. Kadanda & Krishna, 2017) based on data spanning the year 2014, Naik and Padhi (2016) based on data from 2002 to 2012, Arora (2016) based on data from 2007 to 2013, and Hiremath and Kattuman (2017) based on data from 1999 to 2014).

For herding, a very widely used measure involving individual stocks is proposed by Lakonishok et al. (1992) referred to as LSV measure henceforth; it is known as the pioneering research on the trading actions of pension fund managers. Herding is measured as the average tendency of a collection of money managers to sell a particular stock at the same time and vice versa, relative to what the money managers would have done if traded independently. Further, the measure assesses the correlation in the trading patterns for a particular group of traders and their propensity to buy and/or sell the same set of stocks. Herding indicatively leads to correlation in trading activities, but the reverse may not necessarily be true. Further, they have also observed no effect of herding and PFT in destabilising the US stock prices for the period of 1985 to 1989. However, it is also observed that the fund managers did not exhibit significant herding or PFT behaviour except in small stocks. There are wide applications of this stock-level measure to check the existence of herding in a number of markets.

A market-wide measure of herding, especially during market stress is proposed by Christie and Huang (1995). They utilize the cross-sectional standard deviation (CSSD) of returns or dispersion as a means to discover herd behaviour during the period of market stress. Using the daily data from New York Stock Exchange and American Stock Exchange-listed firms from 1962 to 1988, they conclude that the market alternates between normal and extreme phases and herding exists in periods of market extremes. A third market-level measure applied in several studies measures herding by cross-sectional absolute deviation (CSAD) proposed by Chang et al. (2000), where they measure non-linearity in the dispersion and return relation. In Chang et al. (2000) in the regression of CSAD of returns, the significantly smaller than zero coefficient of the squared excess return is interpreted as evidence for herding. However, Bohl et al. (2015) show that the true coefficient is positive under the null hypothesis of no herding. By and large, CSAD has been widely used as a measure of herding, even in the recent literature as unlike CSSD measure, it examines herding during normal up and down markets [e.g. Galariotis et al. (2016); Vidal-Tomás et al. (2019)].

For herding too, India has mixed evidence. For example, Patro and Kanagaraj (2012) by identifying the deviation of stock prices from overall market prices report a high level of herding. Batra (2003), Sehgal and Tripathi (2009) and Tayde and Nageswara Rao (2011) report strong herding tendency among the FIIs using LSV measure and modified herding measure on BSE listed stocks. Many studies report weak evidence of herding [e.g. Lao and Singh (2011) using CSAD on top 300 BSE listed firms, Garg and Gulati (2013) using CSSD and CSAD on NSE 500 firms, and Bhaduri and Mahapatra (2013) using cross-sectional absolute mean-median difference on BSE 500 firms]. Garg et al. (2016) using daily data of 50 stocks of S&P CNX Nifty, report the existence of buy-side and sell-side herding in the Indian stock market. Also, Lakshman et al. (2013) observe that herding is not very severe in the Indian market and policymakers need not be unduly concerned about herding; also, overall market-level herding is not impacted by the size of FII flows. But, Satish and Padmasree (2018), based on daily and weekly data on NSE from 2003 to 2017 apply CSAD and observe no herding before or after the financial crisis. Prosad et al. (2012) also find no evidence of herding in NSE based on daily data for the period of April 2006 to March 2011, by applying CSSD as well as CSAD-based methods.

3 Data and Methodology

3.1 Data

The sample period in the study covers the period from 2014 to 2019, which included phases of both moderate and slow economic growth. Indian economy made a quick comeback in 2010 after the 2007–2008 worldwide financial crisis. But it again went into a slump in 2013 owing to high inflation, rise in fiscal and current account deficits and other factors. Financial stability was adversely affected. But the economic growth again started recovering from 2014 to 2015.

To examine the presence of PFT, daily data on the net investments (purchase–sales) made by FIIs in the Indian equity and debt markets (both NSE and BSE) has been collected from the National Securities Depository Limited (NSDL) website. The daily data spans from April 1, 2014 to November 30, 2019.

In order to explore herding behaviour at the stock level using the LSV measure, quarterly data on the shareholding by FIIs (i.e.no. of shares held by FIIs) in 50 stocks of NSE (henceforth Nifty 50) and 30 stocks of BSE Sensex (henceforth BSE 30) from March 2014 to September 2019 have been taken. Both the indexes are well‐diversified and thereby are true representatives of the Indian stock market. For estimating market-level herding during stress, for the same period, the daily data on the adjusted closing stock price for stocks listed on Nifty 50 and BSE 30 along with the return on respective market indexes are taken. The data is sourced from the Centre for Monitoring Indian Economy (CMIE) Prowess database.

The descriptive statistics of the data is presented in Table 1. Both mean and median cash flow in equity is much greater than that of debt. The higher standard deviation in equity market cash flow further suggests that foreign investment in the equity market is more volatile compared to debt. Table 1 also reports the results of unit root tests on debt and equity inflow/outflow series using the Augmented Dicky Fuller (ADF) test. It is observed that FII inflow and outflow on debt and equity are stationary at a level. Table 1 indicates that the foreign investors on average invest more in the equity markets of India compared to its debt market. The log of Nifty 50 and log of BSE 30 both are integrated of order 1 and the return series and the dispersion of both indexes are stationary.

3.2 Methodology

In this subsection, we first discuss the methods employed for measuring PFT, followed by those adopted for herding.

3.2.1 Positive Feedback Trading

Positive feedback traders end up selling (buying) securities when the price of stocks falls (rises). This pattern can result from predictive expectations about prices. Thus, feedback trading predicts a relationship between the past performance of the market and the FII investment prevailing at present. This may be described as return-chasing behaviour.

The two constituents of FII flows are FII inflows and outflows. The percentage returns on daily data are calculated for the Nifty 50 and BSE 30, considered to be the barometers of the stock market performance in India. They incorporate bluechip stocks for a number of sectors. Returns in percent are computed as:

where Rt = returns at time period t. Pt and Pt−l = closing value of the stock price index at time Pt and Pt−l.

In order to determine the causality or direction of influence, we conduct Granger linear causality test that detects lead and lag relationships between variables. We test this for lags 1 to 4 for the daily data.Footnote 2 If the causality is running from the market return to FII purchase or sales, we may conclude the existence of PFT.

3.2.2 Herding

Institutional investors may differ from the defined set of explanations for herding. For example, a fund manager faces regular reviews on their performance relative to a benchmark and this may explain, to a great extent, why fund managers mimic each other’s trading behaviour. In this paper, we try to determine whether in the Indian context FIIs tend to cluster on the same side of the market. To verify this, we employ a number of methods to test for the presence of herding. First, using LSV measure, we try to identify the existence of herding at the stock level. Second, using the measure of Cross-Sectional Standard Deviation (CSSD) by Christie and Huang (1995), we check herding during market stress by using market-level data on stocks. Third, we also verify herding by Cross-Sectional Absolute Deviation (CSAD) by Chang et al. (2000) to check for asymmetry in herding during bullish and bearish markets. The three measures mentioned are described below.

3.2.2.1 The LSV measure

The LSV measure is expressed as:

where HM = Herding Measure, f(t) is the proportion of buy trade by FIIs on day t. E|f(t) − E[f(t)]| is the adjustment factor to allow for random variation around the expected proportion of ‘buys’ under the null hypothesis of independent trading decisions by FIIs. The adjustment factor assumes that f(t) follows a binomial distribution with the probability E[f(t)] of success. For E[f(t)], the average ‘buy’ trade during the entire period of reference is used.

Implicitly it defines and measures herding as the tendency of a subgroup of investors to trade a given stock (in this study, this is stock index) together and in the same direction, more often than would be expected by the investors trading randomly and independently. The average of HM over the entire sample period gives the extent to which FIIs herd in India. Values of herding measure significantly different from zero are interpreted as evidence of herd behaviour.

If the PFT strategy has been followed by FIIs in the Indian equity markets, it indicates the possibility of herding in an individual stock. We examine individual stock herding measure of FIIs for 50 stocks of Nifty 50 as well as for 30 stocks listed on BSE 30 as of 30 November, 2019. We compute herding using quarterly shareholding of respective stocks by FIIs. Our measure of herding for a given stock in a given quarter H (i, t) is defined as follows:

where H(i, t) is the measure of herding in stock i for quarter t. p(i, t) is the total number of shares held by FIls in stock i at quarter t. p(t) is the average number of shares held by FIIs in stock i at quarter t. The adjustment factor is AF(i t) = E[|p(i, t) − p(t)|], expectation is calculated under the null hypothesis that p(i, t) follows a binomial distribution.

3.2.2.2 Herding During Market Stress

The methodology adopted by Christie and Huang (1995) utilizes dispersion as a means to discover herd behaviour during the period of market stress.Footnote 3 The model draws inspiration from the rational asset pricing model. Here, dispersion implies how much of an investor decision strays away from the market return. When the difference between individual return and the mean market return is close to zero then it may imply that all the return moves in perfect unison with the market indicating dispersion to be the lowest. Similarly, when an individual return deviates from the market return, the dispersion increases. We explore whether dispersion is significantly higher or lower than average during periods of extreme market movements.

To investigate herding in the market setting we measure the dispersion of equity return by employing cross-sectional standard deviation (CSSD) of returns. The measure is defined as:

where ri,t = the observed return on firm i at time t. rm,t = the cross-sectional average of the n returns in the aggregate market portfolio at time t

The expression measures the degree to which individual stock returns tend to rise or fall in relation to the overall market return. A low dispersion is indicative of the presence of herding as security return will not stray too far away from the aggregate market return. This rationale is based on the assumption that individuals suppress their own beliefs and make investment decisions based solely on the collective actions of the market.Footnote 4 The dispersion series computed by CSSD, based on Nifty 50 and BSE 30 separately, are presented in Figures 2 and 3. Both the series are stationary and that is evident from the figures. The figures also point out that the patterns of the CSSD series for both markets are very similar, with an average of around 0.016 and 0.014 respectively. Even the extreme values of dispersion based on CSSD occur around the same time during the sample period in both the markets. We have also looked at the scatter plots of dispersion series based on CSSD for Nifty 50 and BSE 30 against the returns and they do not show any positive or negative trend. This indicates that herding may not be prevalent in the Indian market.

Then, in a regression, whether equity return dispersions are significantly higher or lower than average during periods of market stress is studied.

where \(D_{t}^{L}\) = 1, if the market return on day t lies in the extreme lower tail of the distribution; and equal to zero otherwise, and \(D_{t}^{U}\) = 1, if the market return on day t lies in the extreme upper tail of the distribution; and equals to zero otherwise.

The dummy variables indicate differences in return dispersions during periods of extreme market stress. Coefficients of the dummy variable indicate the possibility of herding by market participants. If the value is negative and statistically significant, it implies that compared to the normal times, dispersion falls during market stress and herding occurs. Market stress is defined by using 1, 5, 10 and 25% of the observations in the upper and lower tails of the market return distribution in this study, though as suggested by Christie and Huang (1995), other studies define only 1 and 5% of the observations in both tails.

3.2.2.3 Non-linearity in Return Dispersion and Average Market Return relation

Christie and Huang (1995) argue that in the presence of herd behaviour, stock returns will not deviate too far from the market return. This will lead to an increase in dispersion at a decreasing rate or, under severe herding, a decrease in dispersion. But during extreme market movements, individuals are more likely to suppress their own beliefs in favour of market consensus. On the contrary, rational asset pricing models predict that equity return dispersions are linear and increasing functions of the market return. But if herding is there, this linear and increasing relation will not hold and instead, the relation may become non-linearly increasing or even decreasing.

We perform an analysis to demonstrate whether a non-linear relationship exists between the return dispersion, as computed earlier, and average market return following the methodology proposed by Chang et al. (2000) and estimate the following models:

\({\text{CSAD}}_{t}\)= cross-sectional absolute deviation of returns in an up or down market.

\({R}_{m,t}^{UP/DOWN}\)= the cross-sectional return in the aggregate market portfolio at time t when the market is up/down.

The model suggests that a negative and significant \({\gamma }_{2}\) implies the presence of herd behaviour. The equations are estimated for all return observations, only positive returns (returns greater than or equal to zero) and only negative returns, respectively for an up and down market. If herding exists, whether it is prevalent at the time of both positive and negative market movements or it is only a one-sided phenomenon is examined. The CSAD series is tested for unit root and it was found to be stationary.

3.2.2.4 Comparison of the Measures for Stressed Market Conditions

In order to compare the results obtained from CSSD and the CSAD measures, we run a separate set of regressions with the CSAD series as the dependent variable. The independent variables are the absolute return and the squared return, but such returns are defined as per the following criteria: (a) as per Christie and Huang (1995), we take the top 25% of actual returns as a proxy for rising market; (b) bottom 25% of actual returns as a proxy for falling market and c. middle 50% of actual returns as a “normal” period. The objective of these regressions is to find out whether asymmetry in the dispersion-return relationship exists in normal times vis-à-vis rising and falling markets. This is also done for BSE 30.

4 Results

4.1 Positive Feedback Trading

Table 2 reports the findings from the Granger Causality test with panel 1 and panel 2 for Nifty 50 returns and BSE 30 returns, respectively. F-statistic at different lags is reported. It is evident that the null hypotheses that return on Nifty 50 do not cause debt inflow/outflow and equity inflow/outflow is rejected at multiple lags mostly at 1% level of significance (or 5% in some cases). This implies that daily equity or debt inflow/outflow from foreign investors follow a daily return of Nifty 50 for the past few days. The existence of PFT corroborates some earlier studies on India [e.g. Arora (2016); Dhingra et al. (2016)]. However, at lag 1 there is evidence of causality from equity inflow/outflow to market return, too. There is no causality from debt inflow/outflow towards Nifty 50 return. Thus, bidirectional causality has been found between Nifty 50 and FII flow in equity, in line with the observations of Mukherjee et al (2002), whereas unidirectional causality is observed from Nifty 50 to FII flow in debt. So, PFT is observed in equity as well as debt investment by FIIs. Similar results are obtained for BSE 30 return, too as for all lags there is evidence of PFT for both equity and debt, whereas the reverse causality is observed only for equity inflow and outflow, for a maximum of 2 lags. Few other studies also find the existence of PFT in both equity and bond market [e.g. Dean and Faff (2008); Sutthisit et al. (2012)]

4.2 Herding

The results based on the herding measure (HM) of individual stocks of Nifty 50 as per LSV, are presented in Table 3. From the HM score, it is evident that there is significant herding in FII investment in 47 out of 50 stocks under study. Out of these 47 stocks, 45 companies experience significant herding at a 1% level of significance. For BSE 30 stocks (Table 4), again significant herding is observed on 29 out of 30 stocks. Interestingly, for three stocks common to both the indexes, findings on herding do not match. For example, HDFC stock shows herding in Nifty 50 but not in BSE 30, while Hindustan Unilever and NTPC exhibit significant herding in BSE 30, but not in Nifty 50. In Nifty 50 the stocks showing no herding pertains to the oil and power sector, viz. Coal India and Indian Oil Corporation, along with NTPC. It should be noted that all 30 stocks included in BSE are also incorporated in Nifty 50. Therefore, out of 30 stocks, only 3 mismatches are there and the majority of the stocks exhibit herding by FIIs in both NSE and BSE. The results corroborate the findings of Batra (2003), Sehgal and Tripathi (2009) and Tayde and Nageswara Rao (2011) which evince strong herding in BSE. However, our findings are different from Satish and Padmasree (2018) and Prosad et al. (2012) who have not reported any herding in Nifty 50 stocks.

The dispersions of returns of the individual stocks from the market returns (CSSD) are computed on daily basis. Panels A and B of Table 5 report descriptive statistics of daily returns of sampled firms from Nifty 50 and BSE 30 indexes respectively. We observe that for Nifty 50 (BSE 30), the average level of dispersion is 1.6 (1.41)% a day across all stocks, with a standard deviation of dispersion is 0.49 (0.46)%. Upper and lower return percentiles show that the return distribution is not symmetric. These are used to define the dummy variables described in Eq. 5.

In the regression with CSSD of all the stocks listed in Nifty 50 (BSE 30) as the dependent variable, there are 1353 observations for each of the indexes. If we take upper and lower 5% (1%) quantile for forming the dummies, the number of observations of daily dispersions within these upper and lower tails are 67 (13). Similarly, for 10% and 25% quantile, it is 135 and 338 respectively. Panels A and B of Table 6 outline the regression estimates of Eq. (5) for Nifty 50 and BSE 30 indexes. It is observed that the coefficients β1 and β2 are positive and significant for both the indexes for all the quantiles. Similar results are obtained for BSE 30, too. This indicates that the dispersions are significantly higher during market stress than at other times. So, there is no indication of herding during extreme market conditions. The reported results conform with the predictions of the rational asset pricing model. It suggests that herding is not an important factor in determining equity returns during periods of large swings in market prices. The results are in conformity with the findings of some other studies on the Indian market, such as Kanojia et al. (2020).

Table 7 presents the estimates of the regression Eqs. 6 and 7. The results from both Nifty 50 and BSE 30 return dispersions (CSAD) suggest that a non-linear relationship between dispersion and returns exists when the market returns are positive, and that is continuously positive at an increasing rate implying that during the conditions of a booming market, herding does not take place. This is because γ2 is positive and significant at a 1% level of significance for a bullish market. However, when the market is falling or the returns are negative, γ2 is positive but not statistically significant implying that such non-linearity does not exist. This indicates, in line with Table 6, that there is no herding in the down market as well. However, it is noteworthy that there is an asymmetry in some sense, between falling and booming markets. In bullish market conditions, FIIs behave more rationally compared to a bearish market, as dispersion increases at an increasing rate in the former case while dispersion increases linearly in the latter case.

In order to compare the results of the two methods in stressed market conditions vis-à-vis normal market conditions, the regression results with CSAD presented in Table 8 should be looked at. Significant autocorrelations in the residuals are present and so the lagged dependent variable is incorporated as an independent variable to take care of the autocorrelations. The results conform to the observations in Tables 6 and 7 and throw light on the normal market conditions, too. Both in BSE 30 and Nifty 50, in normal market conditions, i.e. for most of the time, dispersion is not significantly influenced by market return at all. So, there is not even a linear relationship during normal times. This implies no herding at all. However, the relationship between dispersion and market return is linear in a falling market whereas there is evidence of non-linearity in a rising market. This reconfirms the asymmetry observed in Tables 6 and 7.

While there is no herding observed based on daily data in stressed market conditions or in up and down-market conditions in general, there is evidence of herding based on quarterly data at the stock level. These results are not directly comparable as LSV is the measure at stock level with specific information on FIIs, while the other two measures are based on market level. However, the results are similar to the findings of previous studies. For instance, results indicate the presence of herding by LSV measure is observed in both BSE and NSE, while in the literature so far evidence is mixed. When it comes to market-based measures, results indicate no herding, even in extreme market conditions. However, there is some kind of asymmetry as investors seem to behave more rationally in a rising market than falling market. The results of no herding are in line with findings by Satish and Padmasree (2018) and Prosad et al. (2012) who use similar measures; but the results are in contrast to some studies that find weak evidence of herding (e.g. Garg et al. (2016), Garg and Gulati (2013), Bhaduri and Mahapatra (2013) among others). Though herding is not present, the result related to asymmetry is somewhat similar to the findings of Yang et al. (2015), who report herding behaviour of market participants in the Pacific countries towards the US is asymmetric during the bull and the bear cycles and the herding effect is more pronounced during the bear phase. Similar asymmetric herding behaviour in the US has also been reported by Fang et al. (2017) as well.

5 Conclusion

The paper makes an attempt to test whether the FIIs are showing some typical trading behaviour observed in developed markets and in most of the developing markets, viz. PFT and herding. India is an emerging economy and one of the favourite destinations of such institutional investors for the last two decades. But whether they are engaging in such behaviour is underexplored. While studies mostly find mixed evidence of PFT in India, studies testing herding are scanty. There are several measures of herding in the literature, but for India, there does not exist any comprehensive study encompassing various measures applied to find out herding by FIIs in India. This paper contributes to the literature by not only considering three different measures of herding but also by taking both the major stock markets and high-frequency data.

The results are quite interesting. First, the study confirms the presence of PFT by FIIs, like some earlier studies. Specifically, such behaviour is exhibited in equity unequivocally, particularly in Nifty 50, but less frequently for debt. Second, applying the methods proposed by Lakonishok et al. (1992), Christie and Huang (1995), and Chang et al. (2000), the study also explores the presence of foreign investors’ herding behaviour at individual stock and market level, under normal and stressed market conditions. The results indicate the existence of intense herding behaviour under normal market conditions, as per LSV measure. This implies that FIIs mimic each other’s behaviour while investing in 94 to 98% of individual stocks. Third, herding behaviour, however, ceases to exist in stressed market conditions. Irrespective of whether the market is moving upwards or downwards in extreme situations, there is no evidence of herding behaviour. Fourth, interestingly, there is evidence of some kind of asymmetry in the response of FIIs during a bullish market compared to a bearish market. It appears that during the rising market they behave more rationally compared to falling market conditions, whereas during most of the times including normal market conditions, there is no evidence of herding.

The findings of this study have strong implications for the investors including domestic institutional investors as well as policymakers. The results provide interesting insights in understanding the trading behaviour of one of the dominant investor groups in the Indian stock market. The study may help the regulators to analyse whether the trading activities of FIIs enhance market volatility. At the same time, the domestic financial institutions that invest in the Indian stock markets may keep in mind the FIIs’ investment behaviour while they decide their strategies.

There may be a number of extensions, for example, during the high vis-à-vis low volatility regime whether herding occurs or not, needs to be examined. Also, with the disruption created in the market with COVID-19 that is unprecedented so far, it is quite possible that investors behaved differently. It needs to be explored whether they continued to follow PFT and herding in the changed scenario.

Notes

Security and Exchange Board of India (SEBI) website.

The lags are selected on the basis of the estimation of a VAR model.

Market stress refers to periods of abnormally large average price movements.

However, a contradicting prediction is offered by the rational asset pricing model which suggests that dispersions will increase with the absolute value of the market return. This is because each asset varies in its sensitivity to the market return.

References

Ah Mand, A., & Sifat, I. (2021). Static and regime dependent herding behaviour: An emerging market case study. Journal of Behavioural and Experimental Finance. https://doi.org/10.1016/j.jbef.2021.100466

Ananthanarayanan, S., Krishnamurti, C., & Sen, N. (2009). Foreign institutional investors and security returns: Evidence from Indian stock exchanges. In: Proceedings of the 7th INFINITI conference on international finance 2009-credit markets, credit institutions and macroeconomic volatility.

Andrikopoulos, P., Kallinterakis, V., Ferreira, M. P. L., & Verousis, T. (2017). Intraday herding on a cross-border exchange. International Review of Financial Analysis, 53, 25–36.

Arora, R. K. (2016). The relation between investment of domestic and foreign institutional investors and stock returns in India. Global Business Review, 17(3), 654–664.

Batra, A. (2003). The Dynamics of Foreign Portfolio Inflows and Equity Returns in India’, Working Paper 109, ICRIER (Indian Council for Research on International Economic Relations).

Bekiros, S., Jlassi, M., Lucey, B., Naoui, K., & Uddin, G. S. (2017). Herding behavior, market sentiment and volatility: Will the bubble resume? The North American Journal of Economics and Finance, 42, 107–131.

Bhaduri, S. N., & Mahapatra, S. D. (2013). Applying an alternative test of herding behavior: A case study of the Indian stock market. Journal of Asian Economics, 25, 43–52.

Bikhchandani, S., & Sharma, S. (2000). Herd behavior in financial markets. IMF Staff Papers, 47(3), 279–310.

Bohl, M., Diesteldorf, J., & Siklos, P. L. (2015). The effect of index futures trading on volatility: three markets for chinese stocks. Chinese Economic Review, 34, 207–224.

Bonser-Neal, C., Jones, S. L., Linnan, D., & Neal, R. (2002). Herding. Indiana University.

Caparrelli, F., D’Arcangelis, A. M., & Cassuto, A. (2004). Herding in the Italian stock market: A case of behavioral finance. The Journal of Behavioral Finance, 5(4), 222–230.

Chakrabarti, R. (2001). FII flows to India: Nature and causes. Money and Finance, 2(7), 61–81.

Chandra, A. (2012). Cause and effect between FII trading behaviour and stock market returns. Journal of Indian Business Research, 4, 286–300.

Chang, E. C., Cheng, J. W., & Khorana, A. (2000). An examination of herd behavior in equity markets: An international perspective. Journal of Banking & Finance, 24(10), 1651–1679.

Chattopadhyay, M., Garg, A. K., & Mitra, S. K. (2018). Herding by foreign institutional investors: An evidential exploration for persistence and predictability. Journal of Behavioral Finance, 19(1), 73–88.

Choe, H., Kho, B.-C., & Stulz, R. M. (1999). Do foreign investors destabilize stock markets? The Korean experience in 1997. Journal of Financial Economics, 54(2), 227–264.

Christie, W. G., & Huang, R. D. (1995). Following the pied piper: Do individual returns herd around the market? Financial Analysts Journal, 51(4), 31–37.

De Long, J. B., Shleifer, A., Summers, L. H., & Waldmann, R. J. (1990). Positive feedback investment strategies and destabilizing rational speculation. The Journal of Finance, 45(2), 379–395.

Dean, W. G., & Faff, R. W. (2008). Evidence of feedback trading with Markov switching regimes. Review of Quantitative Finance and Accounting, 30(2), 133–151.

Demirer, R., Leggio, K. B., & Lien, D. (2019). Herding and flash events: Evidence from the 2010 flash crash. Finance Research Letters. https://doi.org/10.1016/j.frl.2018.12.018

Devenow, A., & Welch, I. (1996). Rational herding in financial economics. European Economic Review, 40(3–5), 603–615.

Dhingra, V. S., Gandhi, S., & Bulsara, H. P. (2016). Foreign institutional investments in India: An empirical analysis of dynamic interactions with stock market return and volatility. IIMB Management Review, 28(4), 212–224.

Economou, F., Kostakis, A., & Philippas, N. (2010). An examination of herd behaviour in four mediterranean stock markets. European Economics and Finance Society Conference Paper.

Erb, C. B., Harvey, C. R., & Viskanta, T. E. (1994). Forecasting international equity correlations. Financial Analysts Journal, 50(6), 32–45.

Fang, H., Shen, C. H., & Lee, Y. H. (2017). The dynamic and asymmetric herding behavior of US equity fund managers in the stock market. International Review of Economics & Finance, 49, 353–369.

Fei, T., & Liu, X. (2021). Herding and market volatility. International Review of Financial Analysis, 78, 101880.

Fitzgerald, E. V. K. (1999). Policy issues in market based and non market based measures to control the volatility of portfolio investment.

Galariotis, E. C., Krokida, S.-I., & Spyrou, S. I. (2016). Bond market investor herding: Evidence from the European financial crisis. International Review of Financial Analysis, 48, 367–375.

Garg, A., & Bodla, B. S. (2011). Impact of the foreign institutional investments on stock market: Evidence from India. Indian Economic Review, 46, 303–322.

Garg, A., & Gulati, R. (2013). Do investors herd in Indian market. Decision, 40(3), 181–196.

Garg, A. K., & Mitra, S. K. (2015). A study of lead-lag relation between FIIs herding and stock market returns in emerging economies: Evidence from India. Decision, 42(3), 279–292.

Garg, A. K., Mitra, S. K., & Kumar, D. (2016). Do foreign institutional investors herd in emerging markets? A study of individual stocks. Decision, 43(3), 281–300.

Gleason, K. C., Mathur, I., & Peterson, M. A. (2004). Analysis of intraday herding behavior among the sector ETFs. Journal of Empirical Finance, 11(5), 681–694.

Global Financial Stability Report (2020). International Monetary Fund, 2020.

Gordon, J. P., & Gupta, P. (2003). Portfolio flows into India: do domestic fundamentals matter? IMFWorking Paper No.03/20.

Grinblatt, M., Titman, S., & Wermers, R. (1995). Momentum investment strategies, portfolio performance, and herding: A study of mutual fund behavior. The American Economic Review, 85, 1088–1105.

Hiremath, G. S., & Kattuman, P. (2017). Foreign portfolio flows and emerging stock market: Is the midnight bell ringing in India? Research in International Business and Finance, 42, 544–558.

Hirshleifer, D. (2001). Investor psychology and asset pricing. The Journal of Finance, 56(4), 1533–1597.

Hudson, Y., Yan, M., & Zhang, D. (2020). Herd behaviour & investor sentiment: Evidence from UK mutual funds. International Review of Financial Analysis, 71, 101494.

Hwang, S., & Salmon, M. (2004). Market stress and herding. Journal of Empirical Finance, 11, 585–616.

Jo, G.-J. (2002). Foreign equity investment in Korea. Association of Korean Economic Studies.

Kabir, M. H., & Shakur, S. (2018). Regime-dependent herding behavior in Asian and Latin American stock markets. Pacific-Basin Finance Journal, 47, 60–78.

Kadanda, D., & Krishna, R. (2017). Relationship between foreign portfolio investments (FPI), domestic institutional investors, and stock market returns in India. International Journal of Financial Management, 7(4), 1.

Kanojia, S., Singh, D., & Goswami, A. (2020). Impact of herding on the returns in the Indian stock market: An empirical study. Review of Behavioral Finance. https://doi.org/10.1108/rbf-01-2020-0017

Khanna, S. (2002). Has India gained from capital account liberalisation? Private capital flows and the Indian economy in the 1990s. IDEAs Conference, 16–19.

Lakonishok, J., Shleifer, A., & Vishny, R. W. (1992). The impact of institutional trading on stock prices. Journal of Financial Economics, 32(1), 23–43. https://doi.org/10.1016/0304-405X(92)90023-Q

Lakshman, M. V., Basu, S., & Vaidyanathan, R. (2013). Market-wide herding and the impact of institutional investors in the Indian capital market. Journal of Emerging Market Finance, 12(2), 197–237.

Lao, P., & Singh, H. (2011). Herding behaviour in the Chinese and Indian stock markets. Journal of Asian Economics, 22(6), 495–506.

Marfatia, H. (2021). What do foreign flows tell us about stock market movements in the presence of permanent and transitory shocks? Studies in Economics and Finance. https://doi.org/10.1108/SEF-05-2021-0213

Mukherjee, P., Bose, S., & Coondoo, D. (2002). Foreign institutional investment in the Indian equity market: An analysis of daily flows during January 1999-May 2002. Money & Finance, 2(9–10).

Naik, P. K., & Padhi, P. (2016). Investor sentiment, stock market returns and volatility: Evidence from National Stock Exchange of India. International Journal of Management Practice, 9(3), 213–237.

Nofsinger, J. R., & Sias, R. W. (1999). Herding and feedback trading by institutional and individual investors. The Journal of Finance, 54(6), 2263–2295.

Onishchenko, O., & Ülkü, N. (2019). Foreign investor trading behavior has evolved. Journal of Multinational Financial Management, 51, 98–115.

Patnaik, I., & Shah, A. (2006). The interplay between capital flows and the domestic Indian financial system. In: Background Paper for Dancing with Giants: China, India, and the Global Economy. Institute for Policy Studies and the World Bank, Washington, DC.

Patro, A., & Kanagaraj, A. (2012). Exploring the herding behaviour in Indian mutual fund industry. Asian Journal of Finance & Accounting, 4(1), 189–204.

Prosad, J. M., Kapoor, S., & Sengupta, J. (2012). An examination of herd behavior: An empirical evidence from Indian equity market. International Journal of Trade, Economics and Finance, 3(2), 154.

Satish, B., & Padmasree, K. (2018). An empirical analysis of herding behaviour in Indian stock market. International Journal of Management Studies, 3(3), 124–132.

Sehgal, S., & Tripathi, N. (2009). Investment strategies of FIIs in the Indian equity market. Vision, 13(1), 11–18.

Solnik, B., Boucrelle, C., & Le Fur, Y. (1996). International market correlation and volatility. Financial Analysts Journal, 52(5), 17–34.

Stavroyiannis, S., & Babalos, V. (2019). Herding behavior in cryptocurrencies revisited: Novel evidence from a TVP model. Journal of Behavioral and Experimental Finance, 22, 57–63.

Sutthisit, J., Wu, S., & Yu, B. (2012). Positive feedback trading in Chinese stock markets: Empirical evidence from Shanghai, Shenzhen, and Hong Kong stock exchanges. Journal of Financial and Economic Practice, 12(1), 34.

Tayde, M., & Nageswara Rao, S. V. D. (2011). Do Foreign Institutional Investors (FIIs) Exhibit Herding and Positive Feedback Trading in Indian Stock Markets? In N. Boubakri, and J.-C. Cosset (Eds.) Institutional Investors in Global Capital Markets (International Finance Review, Vol. 12) (pp. 169–185). Bingley: Emerald Group Publishing Limited.

Ülkü, N. (2015). The interaction between foreigners’ trading and stock market returns in emerging Europe. Journal of Empirical Finance, 33, 243–262.

Vidal-Tomás, D., Ibáñez, A. M., & Farinós, J. E. (2019). Herding in the cryptocurrency market: CSSD and CSAD approaches. Finance Research Letters, 30, 181–186.

Wang, D. (2008). Herd behavior towards the market index: Evidence from 21 financial markets. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1316783

Yang, S.-J., Hsu, A.-C., Lai, S.-Y., & Lee, C.-C. (2015). Empirical investigation of herding behavior in East Asian stock markets toward the US market. International Journal of Business and Finance Research, 9(1), 19–31.

Zhang, J., Mao, R., Wang, J., & Xing, M. (2021). The way back home: Trading behaviours of foreign institutional investors in China amid the COVID-19 pandemic. Pacific-Basin Finance Journal, 68, 101618.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Mukherjee, P., Tiwari, S. Trading Behaviour of Foreign Institutional Investors: Evidence from Indian Stock Markets. Asia-Pac Financ Markets 29, 605–629 (2022). https://doi.org/10.1007/s10690-022-09361-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10690-022-09361-z

Keywords

- Foreign investment

- Feedback trading

- Herding

- Indian stock market

- Trading behaviour

- Institutional investment