- India

- International

FII inflow in 2016: Betting big on the India growth story

Despite rising inflation & elusive revenue growth, foreign investors have continued to invest in Indian equities. Retail investors should take a cue, experts say.

A survey of foreign portfolio investors conducted by PWC reveals that India remains a top investment destination for a majority of over 200 FPIs polled in the survey. (Illustration: CR Sasikumar)

A survey of foreign portfolio investors conducted by PWC reveals that India remains a top investment destination for a majority of over 200 FPIs polled in the survey. (Illustration: CR Sasikumar)

Revenue growth remains elusive for India Inc and retail inflation has inched back to over 6 per cent, thereby diminishing hopes of an interest rate cut by the Reserve Bank of India in the near future. However, foreign institutional investors (FIIs) remain optimistic about the India growth story and are investing strongly.

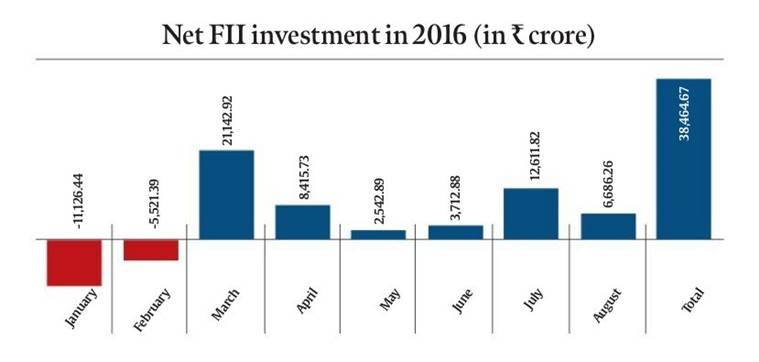

Experts often say that retail investors should take cues from FII investment trends. It may come as a reassurance to retail investors that despite a turbulent first two months of the calendar 2016 when global markets fell sharply over China’s growth woes and dip in crude oil prices (that pushed FIIs to pull out funds from Indian markets), the net FII inflow into the Indian equities stood strong at Rs 38,464 crore for the calendar 2016 till August 16.

If data for the first two months are excluded then the inflow for the last six months amounts to Rs 55,112 crore. During the six-month period the Sensex also witnessed a 22 per cent jump. By comparison, the net inflow in calendar 2015 amounted to Rs 17,806 crore.

While good monsoons and a resultant revival of demand in the economy is something that is playing on the minds of investors, a survey of foreign portfolio investors (FPI) conducted by PricewaterhouseCoopers reveals that India remains a top investment destination for a majority of over 200 FPIs polled in the survey. They feel that not only the growth rates in India are expected to be strong but the country also has a favourable trade and settlement cycle, moderate tax rates and adequate investment limits. “While the world economy is expected to grow at 3.2 per cent in 2016, India’s growth is projected to range between 7.4 per cent and 8.5 per cent. An acceptable range of fiscal and revenue deficits, along with easing prices and a good monsoon, is supporting growth. Overall, the Indian economy is performing relatively better than its counterparts — a position that is evident in the results of our survey as well,” said Suresh Swamy, partner, PricewaterhouseCoopers.

Corporate profitability expected to take-off

As demand in the economy remains sluggish, India Inc has not seen any meaningful revival in revenue growth. Even the credit growth data of Reserve Bank of India shows that the demand for credit remains weak as companies are currently operating at low capacity utilisations. In June 2016, the credit growth for scheduled commercial banks stood at a low of 7.3 per cent.

According to data compiled by Care Ratings, the group of 888 companies (excluding banks, financing companies and refineries) that announced their results for the quarter ended June 2016, posted a modest year-on-year revenue growth of 5.13 per cent. This was lower than the 5.2 per cent growth in revenues registered by the same group of companies in the quarter ended June, 2015. The profits, however, improved for the group of companies on account of increase in efficiency by companies and reigning low commodity prices that have resulted into low input cost for a large number of firms.

The group of companies witnessed a year-on-year profit growth of 8.3 per cent in June 2016 as against a contraction of 2.2 per cent witnessed in June 2015.

While the economy continues to suffer from low demand, resulting into low revenue growth for companies, experts feel that a good monsoon and implementation of the 7th Pay Commission recommendations may revive the demand situation in the economy.

“We expect net profits of the Nifty-50 Index to grow 14.4 per cent in FY17 and 20.7 per cent in FY18 led by general economic recovery and normalisation of profits and profitability in several sectors,” said Sanjeev Prasad, senior ED & Co head (strategy) at Kotak Institutional Equities. He added: “Strong expected growth in earnings of the market over the two next two years reflects higher profits in PSU banks due to lower credit costs; sharp improvement in profitability of the metals & mining sector due to the imposition of anti-dumping duty on steel and higher commodity prices; domestic economic recovery, led by consumption due to normal monsoons and 7CPC implementation.”

So, even though the corporate profitability in the quarter ended June 2016 has failed to impress market experts, they continue to maintain their optimism on higher growth in future.

While inflation concerns have grown over the last few days after the July data showed CPI inflation accelerating to 6.07 per cent as against 5.77 per cent in June, many feel that it won’t sustain for long and is likely to soften going forward. Pushed up by pick-up in food prices led by sharp increase in prices of vegetable, eggs, pulses and sugar, there are expectations that going forward, improvement in sowing along with better reservoir levels and supply management response should help contain food price pressures and investors should keep that in mind.

“We maintain that the recent surge in food prices will begin to fade in the following weeks and a favourable base effect will keep the H2FY17 inflation trajectory in comfort zone. We pencil in a 25 bps of a rate cut in CY2016. However, we remain cautious on future policy actions beyond FY17,” said a report by Kotak Institutional equities. The report, however, cautioned of an upside risks to FY18 inflation emanating from 7th CPC implementation, strong monsoon and GST implementation.

May 17: Latest News

- 01

- 02

- 03

- 04

- 05