India aims to develop as a gas-based economy with 15% of the energy basket sourced from natural gas. Presently, natural gas constitutes only around 7% of the energy basket. While there are many infrastructural, technological interventions that help India in meeting the target, this article will focus on the commerce of India’s Natural Gas.

There are two ways of sourcing natural gas:

a) Imports, and

b) Domestic gas production.

Let’s see in detail how commerce in each of them is working.

Imports:

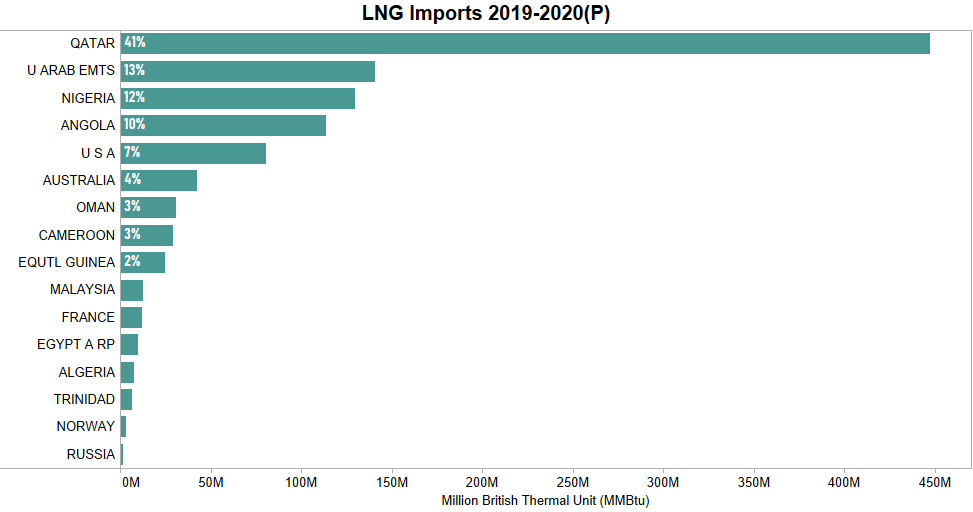

About 50% of the overall need for natural gas is met through imports. Out of which India is predominantly dependent on Qatar, which alone provides 41% of our imports. The following are the countries providing India with Natural Gas.

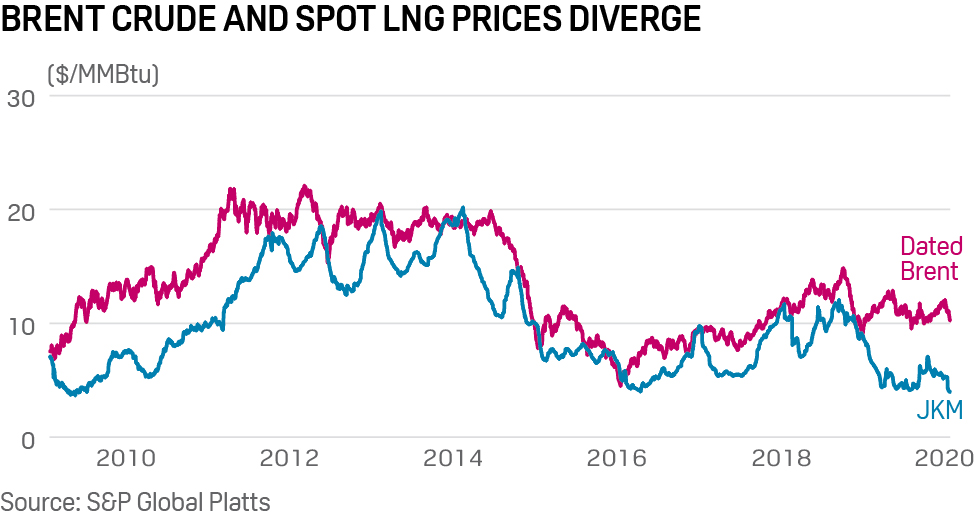

The price for the LNG imports is done in two ways. One is the oil-linked gas price, in which the LNG prices are linked to other oil price indices. This method of pricing is widely used. The other way of pricing gas is a Hub based mechanism, in which the market dynamics of demand-supply come into action. India recently started the “India Gas Exchange (IGX)” to leverage this approach.

What is the purpose of India Gas Exchange (IGX)?

Currently, most of the gas-contracts of India are oil-linked. This brought along two problems:

- No flexibility in the contracts as the oil-linked contracts are generally long-term – a minimum of 6 months. Many small-scale gas users find it difficult to get into such long-term contracts. The IGX presents a solution for them where daily, weekly, monthly contracts are possible; similar to a stock market.

- Poor Price Discovery: Oil and Gas have separate user-base and market. Linking gas prices to oil often led to improper price for gas. That is what had happened during the COVID-19 crisis. The price of Natural Gas in the spot market is half of the oil-linked price. it is for this reason India wants to re-negotiate the long-term deals with Qatar.

It is these two problems that the IGX will address. One week after its inaugration, it discovered a price of 4.05 $/MMBtu, which is way lesser than present India’s LNG import price.

Domestic Gas:

Domestic gas is mostly produced by the National Oil Companies (NOCs). Domestic gas is not yet part of the IGX platform. The price of the Domestic Gas is fixed by the government on the basis of 2014 Pricing Guidelines.

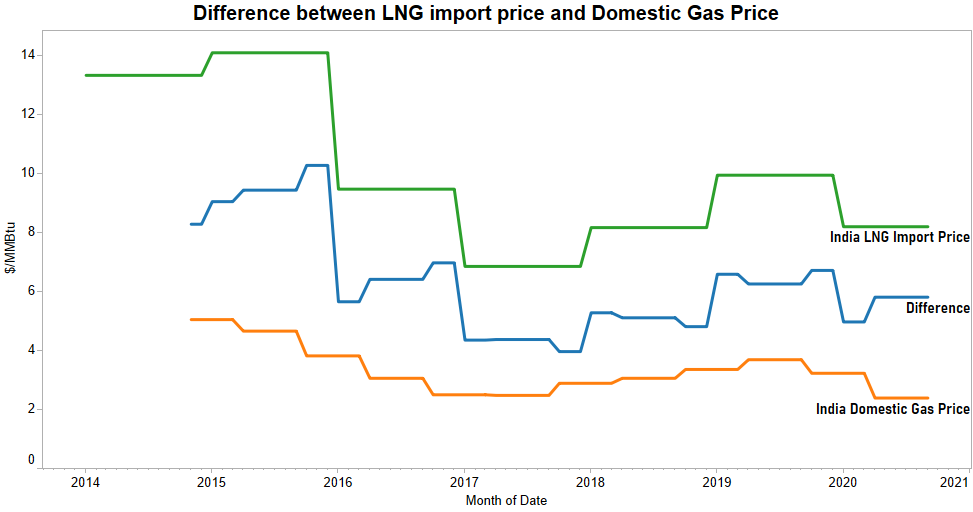

The International Energy Agency (IEA) has slammed India’s domestic gas pricing because of it’s poor price discovery. While the problem with imports is of high price, it is the problem of low-price with domestic gas. Many NOCs have complained that the domestic gas price is so low that it is not viable to produce gas. On an average, there is a 6$ difference between what India is paying for imported gas and domestic gas.

The low price doesn’t mean that the consumers of domestic gas are benefited. Natural Gas, unlike Coal and LPG, is still not under GST and so subjected to various state VATs. These high taxes and low price discovery is affecting India’s domestic gas production – thereby harming our goal of becoming a Gas-Based Economy.

Recommendations:

- Leverage spot markets: Long-term contracts help in providing us with Energy Security and thus should be honored. But India should increase it’s infrastructural capacity to leverage spot markets.

This requires investments into more LNG terminals, pipelines etc.

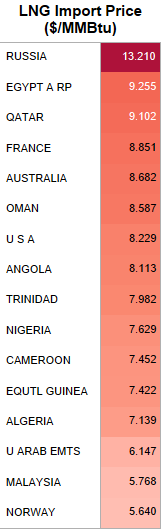

This requires investments into more LNG terminals, pipelines etc. - Diversify LNG imports: Qatar lies in a Geo-political hot spot. The Strait of Hormuz is never free from security crises and that puts 40% of India’s LNG imports at risk. India should diversify LNG imports for preserving Energy security. USA, Australia have abundant LPG reserves to mention.Moreover, we can observe from the adjoining table that the price of LNG is low in African countries. Indian companies should invest in the exploration of Oil and Gas in Africa to make our Natural Gas supply more robust and efficient.

- Domestic Gas on IGX: Domestic Gas produced should be allowed to be traded on IGX so that the higher price than the existing $2.39/MMBtu will incentivize domestic producers.

- Include Natural Gas in GST: Inclusion in GST not only benefits the consumer, but also the businesses. It will increase the Ease of Doing Business in the Natural Gas Sector due to uniform taxation. It will also allow the businesses to claim Input-Tax credit thus increasing the viability of gas production.

India’s per-capita energy usage is one-third of the global average. Energy is a key determinant of quality of life. The Economic Survey 2018-19 estimated that India should quadruple energy usage to reach a high Human Development Index (HDI) of 0.8. To do it sustainably, India needs to leverage Natural Gas. The reforms in the taxation, pricing and trade of LNG will thus become crucial in India’s journey of becoming a Gas-Based Economy.